This is not investment advice. Always do your own research and speak with your financial adviser before you invest.

In the world of tech investing, FOMO has given way to fear. Private company valuations have followed public companies. What used to be 20-30x revenue is now 5-10x. And there is even speculation that 2-3x could be on the menu in 2023. But is 3x ARR even possible?

EMCLOUD is Bessemer’s Emerging Cloud Index. A collection of 75 public SaaS/Cloud companies like Salesforce, Hubspot and Snowflake. Industry leaders. Amazing businesses.

As late as September 2021, the median ARR multiple was 18.4x. It’s now hovering at 5.4x. That’s a 71% drop. A proper shellacking. Feels like tech investors have had enough pain.

Light ahead

But there is hope! On Monday, Thoma Bravo (a Private Equity firm) announced an $8bn acquisition of Coupa. The eminent Tom Tunguz had a great analysis on his blog the same day.

As Tunguz points out, this is the most substantive acquisition since Adobe acquired Figma. The M&A market may be improving. That’s good news.

And importantly, the deal shows that there may be an upside in tech valuations.

| Forward Multiple | Growth Rate | Efficiency | |

|---|---|---|---|

| Coupla | 7.8x | 17.0% | 39.6% |

| Median SaaS (EMCLOUD) | 4.6x | 26.4% | 32.2% |

Thoma Bravo paid a 31% premium to the public price. They also paid a 7.8x multiple on forward revenue. That is higher than the industry median of 4.6x.

The average public cloud company grows 56% faster than Coupla. Would investors be willing to pay 56% above Coupla’s valuation multiple of 7.9x? I.e. 12.3x forward revenue? That would be a nice upside to where we are now!

I am a technologist. So – by definition – I am an incurable optimist. However, there is a strong argument that we could decline further before markets rebound. Here is another interpretation of the price Thoma Bravo paid.

A year ago, tech companies were mainly valued on growth. Faster growth = higher valuation multiple. But as of 2022, Efficiency has replaced growth. And what is Efficiency? It’s revenue growth % + Free Cash Flow %. Revenue growth of 30% and a Free Cash Flow % of 10% give an Efficiency score of 40%. And it turns out that Coupla’s efficiency was 23% higher than the median SaaS company.

Coupla grew more slowly than the peer group. But their free cash flows were better. And Private Equity firms like free cash flows.

By this logic, the implied valuation of the deal isn’t 12.3x for the median SaaS company. It’s 6.4x. Slightly higher than where we are today. But not terribly exciting.

So is it up or down from here?

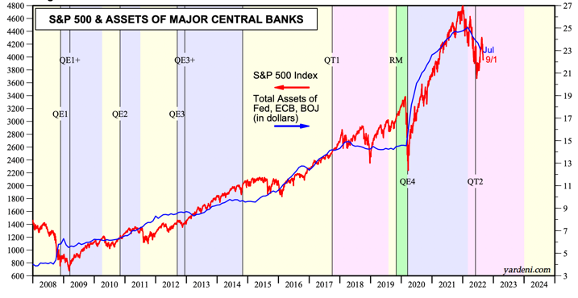

The S&P500 is at roughly 4,000 at the time of writing. There are different ways to analyse the possible path from here. Historically, the S&P500 has been closely tied to liquidity and quantitative easing. As central banks expanded their balance sheets, the S&P500 went up, up, up. All that has come to an end now.

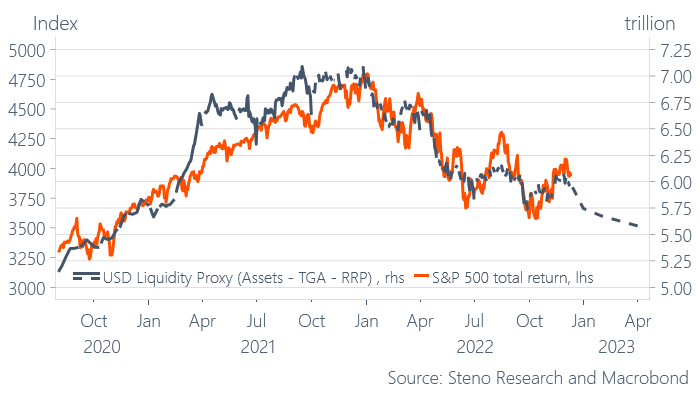

Based on an analysis of the likely Quantitative Tightening in 2023, Steno Research is calling the floor at 3,500 next year.

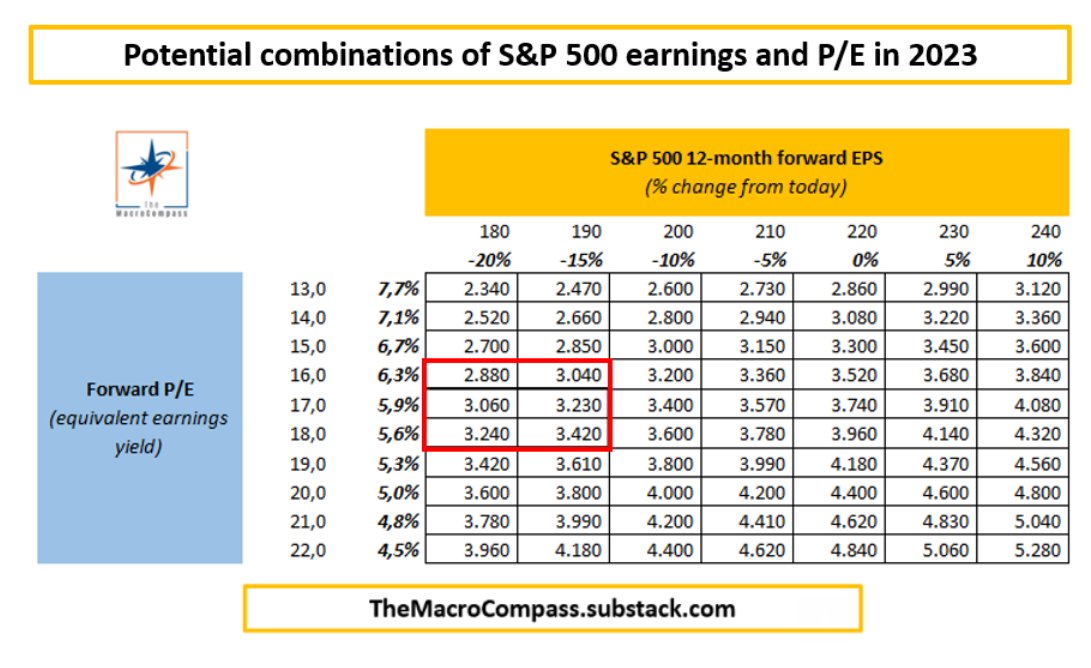

Alfonso Peccatiello sees the floor at 3,250 based on recession and declining company earnings.

That’s a further decline of 12.5% – 18.75%.

The EMCLOUD Index is a great way to track public cloud/SaaS companies. It has a Beta of 1.16 to S&P500. This could mean that SaaS companies have a further 15-20% to go.

And 20% off the current median 5.4x ARR multiple is 4.3x. Not quite 3x. But not pleasant reading either.

Do I think we can see those valuations in 2023? It’s not unthinkable. I also don’t think it is the most likely outcome. But, whatever your expectations, it seems clear to me that we aren’t out of the woods quite yet. Better get ready for another few rounds on the roller-coaster.

(Note – I am using EMCLOUD data which is slightly different than Tunguz’. Directionally, the analysis is the same).