October 2024 marked significant shifts in the technology and venture capital landscapes. Nvidia continued its impressive ascent, but rising US interest rates presented fresh challenges. The upcoming U.S. presidential election between Donald Trump and Kamala Harris added another layer of complexity, influencing market sentiments and inflation expectations. Venture funding remained concentrated in AI and B2B SaaS, amid liquidity constraints and regulatory changes affecting mergers and acquisitions. This article examines these trends and their implications for VC investors as we approach year-end.

This month, we look at:

- Nvidia’s continued outperformance

- The upcoming US election and what it means for the global economy

- Trends in venture capital, and

- General trends in AI and technology.

Stock Market and Economic Indicators

Nvidia and the Nasdaq’s Performance

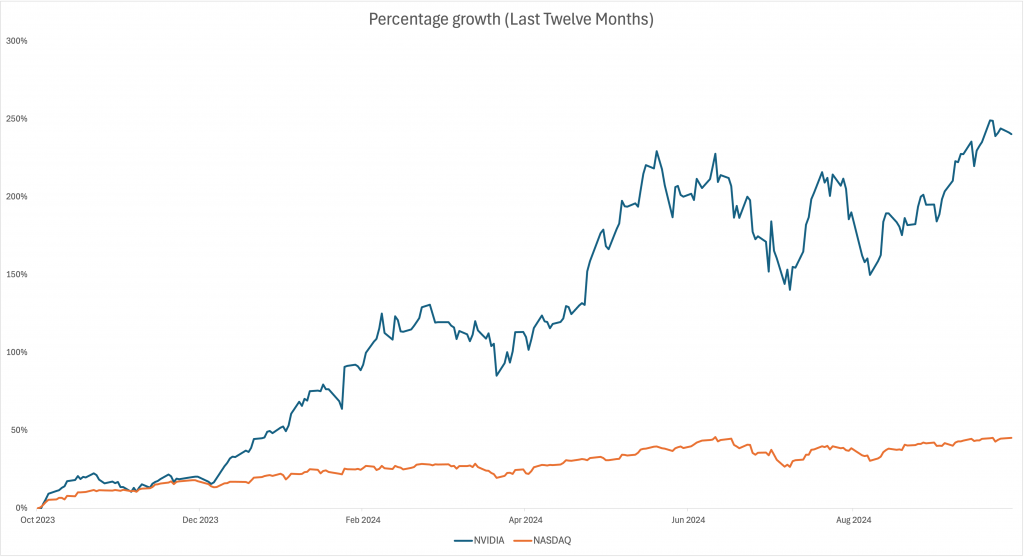

Nvidia’s stock surged more than 20% during the first three weeks of October, before falling back to leave the share price up “just” shy of a 10% gain for the month. The overall growth was driven by extraordinary demand for its Blackwell chip, which delivers up to 2.5 times the performance of its predecessor, Hopper. The Blackwell GPU is fully booked 12 months in advance, reflecting a backlog due to high demand from companies like Meta, Microsoft, and OpenAI. Nvidia’s CEO Jensen Huang notes that they are “early in a long-term AI investment cycle.” Analysts expect Nvidia’s revenue to double this fiscal year.

This robust performance contributed significantly to pushing the Nasdaq to a record high in October. The sustained demand for generative AI infrastructure—from models like ChatGPT to Microsoft’s AI Copilot—demonstrates the foundational role of Nvidia’s GPUs in supporting AI-driven applications.

S&P 500 Trends

S&P500 and the Nasdaq-100 had a largely quiet October before pulling a few percentage points back in the first few days of the month. Once again, it was mainly the “Magnificent Seven” tech companies that were driving performance in the indices.

Interest Rates, Inflation, and the Upcoming U.S. Presidential Election

U.S. Inflation Rate and Treasury Yields

Inflation remains steady at 2.4%, but yields on the 10-year Treasury have risen sharply—from below 3.75% in mid-September to over 4.25% in October. This rise reflects cautious sentiment in bond markets and has significant implications for sectors like venture capital and tech, where higher borrowing costs may affect valuations and access to capital.

Impact of the 2024 U.S. Presidential Election on Markets

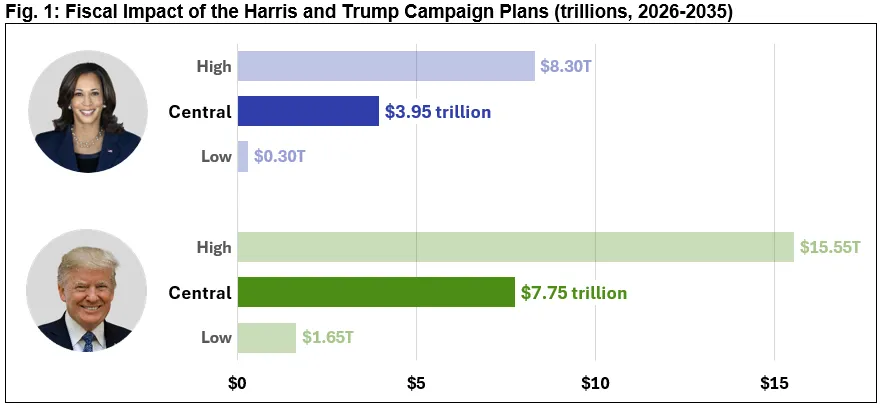

With the 2024 U.S. presidential election approaching, concerns about rising inflation are intensifying. Both major candidates, Donald Trump and Kamala Harris, propose fiscal policies that may fuel inflation, albeit through different mechanisms. Importantly, both candidates signal continued high deficit spending, albeit Trump has been discussing working with Elon Musk to “cut $2 Trillion from the US Budget.

Source: CRFB

Given that both policies could be pushing inflation, “safe-haven assets” like gold (up 30% this year) and Bitcoin (up ca 50% this year) have been surging. With Trump currently the most likely winner of the election, let’s unpack his policies further.

Trump’s Policies and Inflationary Drivers

Trump’s proposals focus on tax cuts, import tariffs, and restrictive immigration measures. His proposal for universal tariffs would raise import costs, directly contributing to consumer inflation. Additionally, forcibly removing millions of illegal immigrants could tighten the labour market, potentially pushing wages higher and compounding inflation. Trump’s aggressive stance on tariffs and immigration, as well as his potential reshaping of Federal Reserve policies, have raised concerns of political interference in monetary policy, which could impact medium-term inflation.

Analysts from sources like the Peterson Institute expect Trump’s fiscal plan to elevate inflation more than Harris’s, with some estimates predicting a 6% to 9% inflation rate by 2028. Let’s hope it doesn’t come to that and that cooler heads will prevail if Trump wins on November 5th.

Venture Capital and B2B SaaS Trends

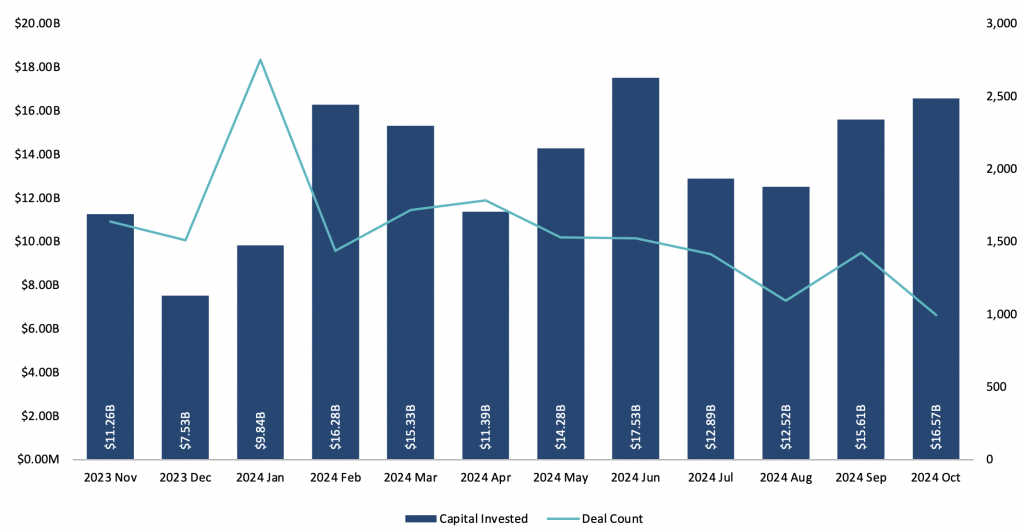

Global Venture Funding in AI and SaaS

Venture funding in applied AI and SaaS remained strong in October 2024, focusing on companies with solid revenue models. Notable funding rounds include:

- OpenAI’s Massive Funding Round: OpenAI raised $6.6 billion in October, nearly doubling its valuation to $157 billion.

- Perplexity AI’s Funding Drive: Perplexity AI, an AI-powered search engine and chatbot startup, initiated discussions to raise approximately $500 million, aiming for a valuation boost to around $8 billion.

Other significant recent rounds include:

- Waymo’s Significant Raise: Waymo secured $5 billion from Alphabet, reinforcing its position in autonomous driving technology.

- Anduril Industries’ Funding: The defence technology company raised $1.5 billion in a round led by Founders Fund.

Safe Superintelligence’s Investment: The AI safety startup founded by former OpenAI co-founder Ilya Sutskever closed a $1 billion round.

Liquidity Challenges and Investor Strategies

The venture market faces liquidity constraints with prolonged exit timelines due to delayed IPOs and mergers. New merger control regulations have further complicated M&A activities, affecting venture capital liquidity. In response, we see both founders and investors adopting more disciplined approaches to capital deployment for anything outside the most well-funded AI companies. There’s a heightened focus on achieving cash flow breakeven—essentially treating every funding round as if it were the last. This shift is expected to lead to more capital-efficient companies capable of sustaining growth amid market volatility.

Trends in AI and Emerging Technologies

Rapidly growing AI’s Market

Bain & Company estimates that AI hardware and software markets will grow from $185bn in 2023 to $780-$990 billion by 2027. The focus currently remains on high-performance infrastructure led by hyperscalers like Microsoft and Alphabet. Microsoft alone invested $56bn on capex in its last fiscal year (ending June 2024), mainly driven by the buildout of AI infrastructure. We see this spending start to shift from hardware to applications as the application set matures over the coming years.

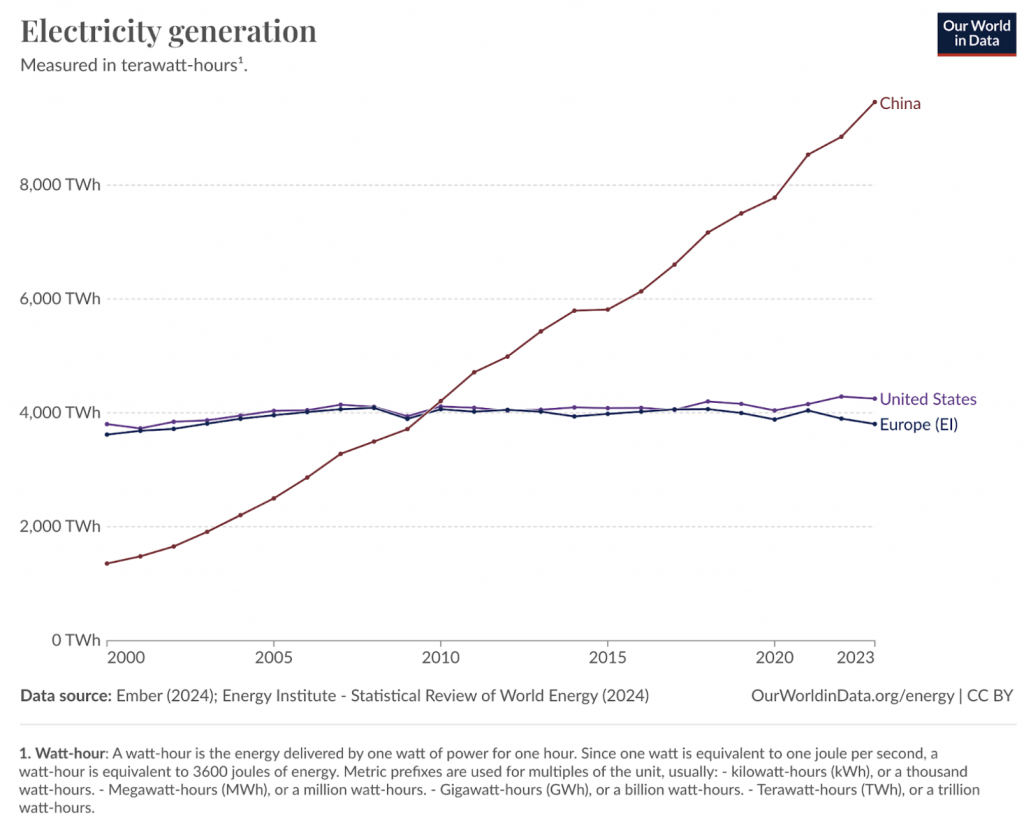

Energy Demands Driven by AI

AI continues to drive a massive spike in energy demands. The U.S. and Europe face significant challenges in meeting projected energy demands over the next decade. The current energy infrastructure is woefully insufficient, with a limited number of new power plants under construction compared to China’s aggressive energy expansion.

Recent nuclear agreements struck by Microsoft and Google underscore the urgency to secure reliable energy sources. Advances in renewables, especially the photovoltaic (PV) buildout in Texas, offer some relief but may not fully bridge the impending energy gap.

Regulatory Environment and Venture Capital in Europe

Continued Shortage of Venture Capital in Europe

The European economy (here loosely defined as the EU + the UK) is ca. $23trn, vs the US GDP of $26trn. So – comparable in size. Even so, the US deploys three times as much venture capital as Europe. And this is precisely one of the reasons why the US continues to grow faster than the European economies.

There are a lot of things we can improve about the European ecosystem, not least put more capital into innovative companies. One of the challenges we face is that European pension funds (particularly in the UK, France, and Germany) operate under regulatory mechanisms that make it difficult to invest in venture capital compared to their Canadian and U.S. counterparts. Regulatory constraints and risk-averse investment mandates limit their participation in the VC ecosystem.

The good news is that this is a problem we can solve. The Mansion House Compact was a first step towards channelling more capital to the innovation economy. There is still a long way to go, but at least we are seeing some steps being taken.

VC Strategy for Q4 2024 and Beyond

As we move into the final quarter of 2024, we continue to emphasise a disciplined investment strategy, focusing on well-run startups with viable paths to growth and profitability. The current environment necessitates a thoughtful deployment of capital, with both founders and investors focusing on achieving cash flow breakeven—essentially treating every funding round as if it were the last. This approach will lead to better, more capital-efficient companies.

The substantial enterprise demand for AI solutions presents significant opportunities for startups in the B2B SaaS space, especially those specialising in AI integration and infrastructure. And this is where we continue to focus.