This is not investment advice

It’s been a super hectic July. Both on the political and the investing front. I am sometimes given flak for putting too much focus on the US, but – as the US goes, so goes the world. Especially in technology (which we will aim to rectify in the long term, but for now, we need to cover what matters).

A new face-off in the US election

At the start of the year, I wrote that it was likely that Trump would win the 2024 election. Trump was ahead in the swing states and Biden had weak approval ratings. The biggest threat to Trump seemed not Biden, but the US courts. The US Supreme Court essentially refused to interfere in the election, and so by June, Trump was all but assured to win. The smart money started lining up behind Trump (including many people who previously denounced him).

Then came the June 27th debate between Biden and Trump, and it became clear to everyone that Biden would not be able to win anything (let alone govern for another four years). What followed was several weeks of painful soul searching for the Democrats, and by July 21st, Biden announced that he was stepping back from the race, endorsing his Vice President Kamala Harris to be the new candidate in his place.

Some people on the Democratic side had hoped for a new primary to help the party find the strongest candidate. Some folks thought Ms Harris would be a weak candidate in her own right. Others pointed out that Democrats always lose after a “coronation” (Gore in 2000, Clinton in 2016).

But then the pundits got surprised again. Kamala Harris has raised $200m in a week to fuel her campaign. Importantly, the Democratic ticket bounced back to the point where it is now neck-and-neck with Trump in the swing states.

Prediction markets currently give Trump a small edge. But a Trump victory is no longer a foregone conclusion. This has implications for tech and markets, as we shall see below.

You can follow prediction markets here.

US Economy – Still Powering Ahead?

US GDP grew 2.8% in Q2, well above market expectations.

At the same time, inflation continued to gradually ease, with core inflation numbers now down to 3.4% (3% for headline inflation). Markets now expect two rate cuts before the end of 2024.

At the same time, it looks like US consumer spending is starting to slow down.

Many US corporates had relatively weak earnings announcements in July, and outlooks for H2 are that growth may have peaked. If growth slows just slightly, and it enables the US to firmly get inflation under control, that’s not a bad thing. This should pave the way for more interest rate cuts, and then we can start a new cycle without first going through a painful recession.

So far, so good.

What is the Medium Term Inflation Outlook?

But what if US inflation is on its way back up again? As discussed above, the 2024 US Presidential election is anything but settled, but Trump is still the front runner (even if only by a smidgen at this point). What has he said about his economic priorities?

Trump has said that he wants:

- Tax breaks. The Federal government is currently running a $1.7 trillion deficit, equal to 6.3 percent of GDP. That’s high by any measure. Tax breaks are unlikely to narrow the deficit gap. Even if Trump cuts some programmes (as he has said he will), it is unlikely that he will dramatically reform entitlement programmes, given his populist platform. So if anything, deficits are likely to stay high. That’s inflationary.

- Trade wars. Trump wants to rebalance trade by putting further tariffs and restrictions on imports. This will make goods more expensive for US consumers, which is inflationary.

- Reduced immigration. Trump wants to eliminate illegal immigration. Leaving aside the emotions surrounding immigration, this will reduce available labour. The US unemployment rate is currently around 4% – already lower than the long-run average. Further immigration restrictions will put pressure on the labour market. This is inflationary.

All else being equal, it’s hard to see how a Trump 2.0 will be anything other than inflationary. That’s got medium-term implications for inflation, rates, markets and the economy at large. Although this won’t impede the business case for investment in technology and automation (technology drives down prices and is deflationary), it will mean that rates will be higher for longer. With all the implications for cost of capital, stock markets etc.

What will a Harris presidency look like? The expectation is that it will be “continuation Biden”, but I don’t know that we know her well enough yet to say for sure.

So there is some uncertainty lined up ahead of us.

And What’s up with Bitcoin?

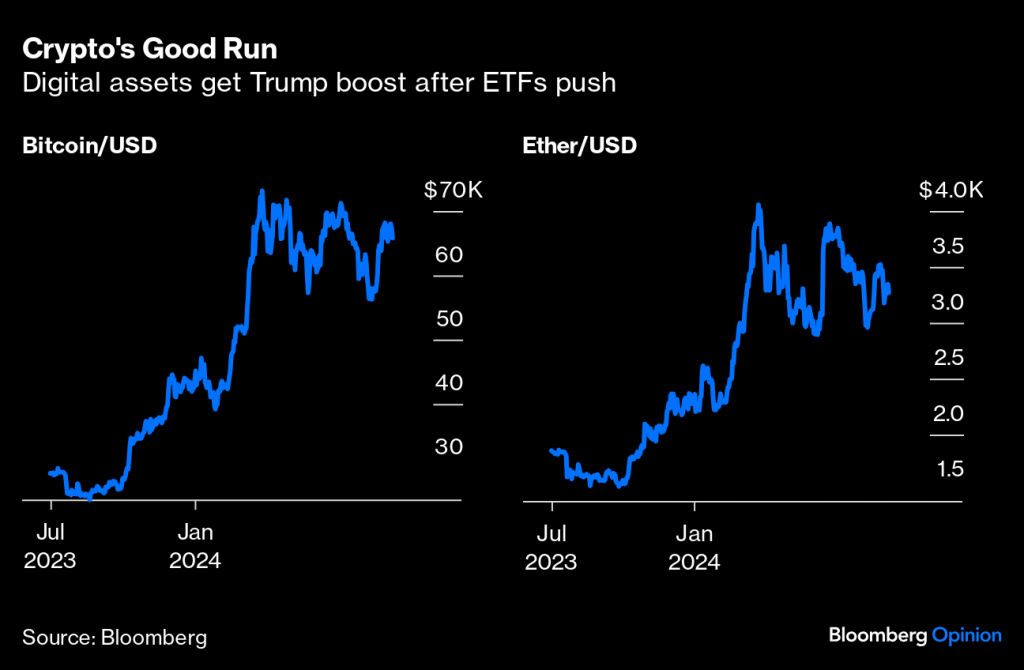

Trump has gone full 180 on Bitcoin. From denouncing it as a scam in 2021, he is now firmly behind the digital currency. “If Bitcoin is going to the moon,” he said, “I want America to be the nation that leads the way”.

He has also said he will sack Gary Gensler (head of the US Securities and Exchange Commission) in his first day in office. Gary Gensler has been spearheading efforts to regulate / curb the rise of digital currencies, and Trump is promising a new regime on this front. We can all speculate as to the motivations behind this, but the implication for the price of Bitcoin seems pretty obvious, and the price is already up >10% in the last fortnight.

US Stock Markets Take a Breather

While Bitcoin was up in July, US equities took a pause. Last month we looked at the ascendancy of Nvidia, as the company hit a $3trn market cap. The company peaked on the 10th of July, and since then, it has declined 23%.

This mirrors Alphabet which is down 11%, Microsoft (down 9%), Tesla (down 15%) and the wider Nasdaq 100 (down 9%) since the peak on July 10th.

On the other hand, the S&P 500 is down a more modest 3.5% since July 10th, as we’ve seen a sector rotation from the Magnificent 7 tech/AI stocks to a broader swathe of the stock market.

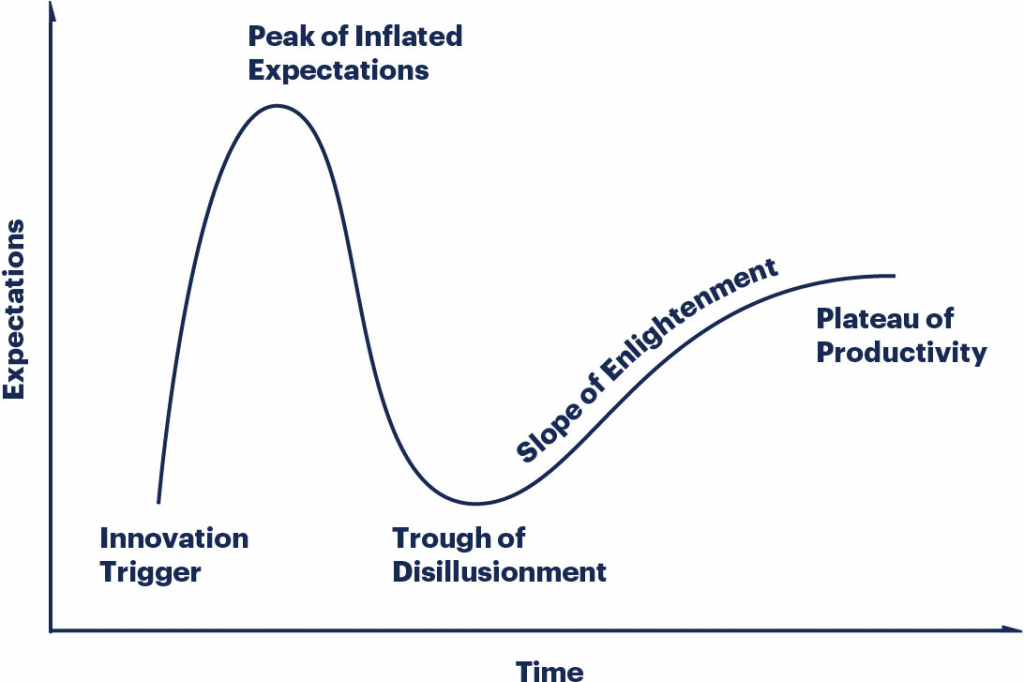

In a short span of time we’ve gone from “AI will change everything overnight”, to “the technology isn’t ready yet and we’ll never recover invested capital”.

At moments such as these, it can be helpful to revisit the good old hype cycle. We have repeatedly said that “yes, there is an AI bubble” and “yes, AI will change the world”, and the two can be true at the same time.

In July, we probably came off the “Peak of Inflated Expectations”, and it’s likely that we have a bit of Disillusionment ahead. But we still see plenty of productivity ahead, both for the economy and for stocks.

What’s Happening with SaaS?

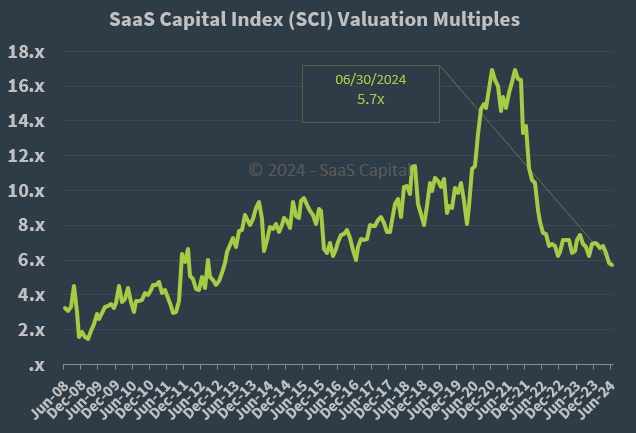

From 2014 to 2022, SaaS companies were highly favoured due to their reliable recurring revenues and substantial growth rates. However, by 2024, the median revenue growth of SaaS companies in the EMCLOUD index dropped below 20%. Revenue multiples are now below 6x, a stark contrast to companies like Nvidia trading at ~25x revenue.

Over the past 12-18 months, corporates have shifted all new tech spend towards AI. This has boosted revenue growth of companies like OpenAI, and slowed revenue growth of more traditional SaaS companies.

As we’ve seen in July, there is a sense that this “headlong rush” into the first wave of AI has started to come to a close. There isn’t enough ROI in deploying generic models from OpenAI, and there is still a lot of customisation work required to make AI work at scale and in production in corporate settings.

The future of AI model enhancement lies in leveraging private, proprietary data within enterprises. This data can differentiate AI models and significantly enhance their capabilities in automating and optimising business operations. This also lends itself well to SaaS applications – often the core repositories of corporate data.

As both incumbent and challenger SaaS vendors start offering AI models based on proprietary data, enterprise customers will start seeing increased ROI from off-the-shelf SaaS platforms. The companies that manage to make this transition will benefit from attractive growth rates. Some of these are already public companies. Others are still being built from the ground up. Those are the startups we invest in.

What Happened in Venture Capital in Q2?

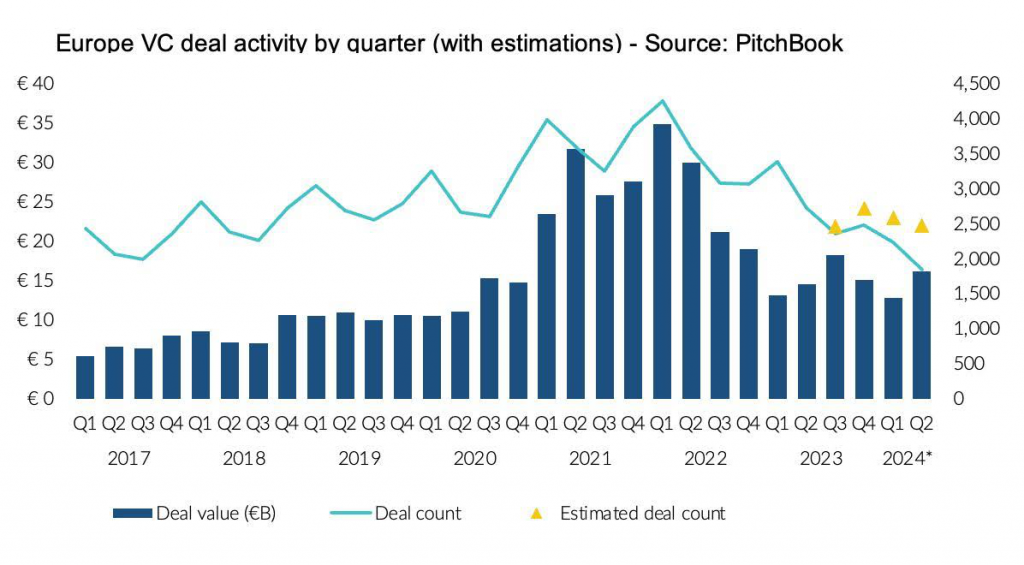

PitchBook recently issued an update on US and European venture capital activity in Q2. The numbers were up across the board. US deal value was up 46% from Q1 (to $56bn) and European deal values up 27% to €16bn. Even when factoring in the $6bn Elon raised for x.ai, it looks promising.

Let’s look under the covers.

- Big jump in round sizes: The median European seed round increased 40% to €2m ($2.15m). That’s a huge jump, and one that is likely to be volatile in future quarters.

- European rounds are still smaller: Although the jump is big, this is still behind the median US seed deal which was $3.1m.

- And Europe still trades at a discount: Even bigger was the valuation gap. Pitchbook estimates 412.4m premoney for the median round in the US, vs $5.5m for the median seed round in Europe. That’s a 56% gap.

- Bigger rounds and (slightly) fewer deals: Pitchbook reported an 18% drop in deal count (so – fewer, larger rounds). However, it often takes a while before rounds are announced. PB estimates that a total of 2,478 rounds were done in Europe in Q2. That would only be a 4% decline on Q1. In other words, about the same number of much bigger rounds.

Overall, the trend is positive. We’ve covered the political and economic uncertainty above, but there is a sense that things are heading in the right direction for venture.

We’ll take that as positive momentum heading into the second half. Onwards!