We are four months into the moment when AI had its popular breakthrough.

Already a few days after the launch of ChatGPT, we knew this was a watershed moment for AI and technology.

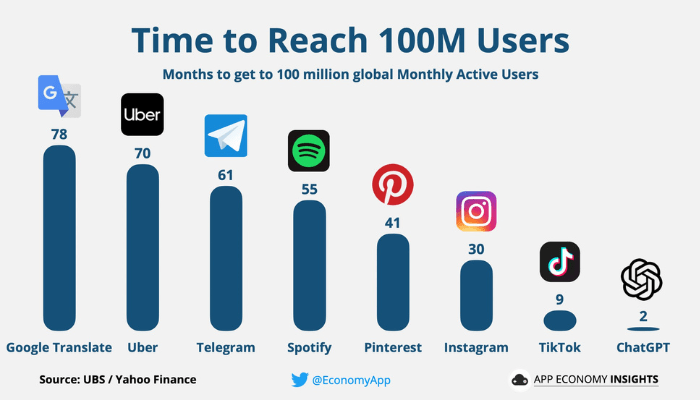

And within two months of launch, ChatGPT became the fastest application in history to reach 100m users.

The algorithm that underpins ChatGPT is GPT – the Generative Pretrained Transformer. It belongs to a branch of algorithms called Large Language Models. In his article The Age of AI has Begun, Bill Gates ranks the LLM technology as one of the greatest tech breakthroughs of our lifetime. In his view, it is as important as the microprocessor, the personal computer, the Internet, and the mobile phone. There is no doubt that this is major news.

Tech giants pivot hard to AI

Since the launch of ChatGPT, the tech world has exploded with innovation. We’ve seen the launch of hundreds of new generative AI startups. Many are fads, but some will have a lasting impact to rival the tech giants of the last big waves.

And the major tech players have been quick to see the opportunity. Most of them have pivoted full-scale to AI.

- Microsoft partnered with OpenAI (developer of ChatGPT) in a $10bn investment. The company is now integrating OpenAI’s algorithms into all their productivity software.

- Google has been ahead in AI for years. But they were reluctant to put their most powerful LLMs into the wild as they feared accuracy issues. Since the launch of ChatGPT, Google declared an internal “code red”. The company has since announced that it will incorporate the technology into pretty much all its products.

- Facebook has been in the wilderness for the past few years, pouring tens of $bn into “the Metaverse”. But following the launch of ChatGPT, Zuckerberg redirected the company towards AI and has been quietly burying the Metaverse. Microsoft and Google are ahead, but I wouldn’t dismiss Facebook just yet.

Rapid innovation

And on March 14th, OpenAI announced GPT-4 – the next generation of the algorithm behind ChatGPT.

It is frighteningly good. GPT-3 (the previous generation) was struggling to “get into Law School”, ranking 40th percentile on the Law School Admission Test (LSAT). GPT-4 didn’t just ace the LSAT; it also passed the Bar exam, scoring in the 90th percentile!

But possibly one of the coolest innovations so far was the use of Generative AI to “revive” Steve Jobs. The legend lives again.

What’s next for AI & B2B Software

Over the past few months, we have heard more and more people both inside and outside the tech ecosystem say: “please slow down”. But I don’t see any “risk” of that happening. The impact of tech is compounding, so we are going to see an acceleration of the level of change over the coming years.

The most immediate and visible manifestation of LLMs is the chatbot. ChatGPT is the prime example, but Google Bard is hot on the heels.

Chatbots are powerful, but they are just the tip of the iceberg for what’s to come.

I expect that generative AI will be integrated in almost all business software. Let’s take the example of industrial manufacturing. Here, AI will transform everything from the synthesis of requirements through the development of designs to the automation of the actual production process.

Most of our portfolio companies are already doing clever things with AI. For example, Ai Build helps large manufacturers in automotive and aerospace use AI to integrate 3D printing into their manufacturing processes. And Garvis AI platform helps large FMCG companies forecast future demand to avoid producing too few or too many units.

Meanwhile, what’s happening in the wider world

While AI is disrupting tech, the world economy is disrupted by the biggest paradigm shift in 40 years. We still see the three major secular shifts being:

- Energy transition,

- Peak globalisation, and

- Income redistribution

In the past 18 months, this has led to rampant inflation and increasing interest rates. During March, things came to a head with several major banking failures. 2023 continues to be a rocky year for the global economy.

So the big AI resurgence is happening against the backdrop of a global economy in trouble.

When two forces collide

As we enter 2023, we are effectively seeing two major forces clash:

- The biggest technology breakthrough in at least a decade

- The biggest paradigm shift for the global economy in 40 years.

This makes for a super interesting investment landscape.

AI and venture capital investing

There has been a raft of venture capital investment in generative AI companies recently.

But overall, venture capital investing is still depressed. According to Tom Tunguz, the number of seed rounds was down 64% in Q1 2023 compared to the same period in 2022. Later stages were even more depressed

This has obvious implications for investors. Carta tracks startup cap tables, and the company has data on funding rounds for more than 30,000 startups.

The Carta team has crunched the numbers and found that US VC investing was down 50% in 2022 compared to 2021. They also report that Q4 of 2022 was the weakest quarter since 2018.

As a result, rounds are smaller, and valuations are lower.

Why we think 2023 is going to be one of the best years in venture

So there we have it. A generational technology breakthrough meets a depressed investment climate. It’s hard to think of a better environment in which to invest in the next crop of great tech founders.

True – many founders are feeling the pinch right now. It’s much harder to raise. But the best companies have trimmed the sails, and they are finding it easier to hire and to focus. For good entrepreneurs, this is a great time to build.

So despite choppy waters, we are very excited for the year ahead.