As AI Scaling Falters, Fusion and Quantum Computing Create a New Innovation Wave

This is not investment advice

“Another $40B Nvidia quarter, another half-billion-dollar AI model—but what if the real breakthroughs lie elsewhere?” As GPT-4.5 disappoints despite its massive price tag, February 2025 reveals a more compelling story: the emergence of a technological trinity. While AI scaling hits diminishing returns, quantum computing and fusion energy are making historic leaps—and the three fields have begun to accelerate each other. After January’s $1 trillion tech rout, this month shows how the future may not belong to bigger AI models alone, but to the powerful synergy between these three technologies—a convergence that matters far more than market fluctuations.

First, let’s look at what happened with public markets in February.

Market Analysis

Stock markets took a hit in February, with the Nasdaq 100 down 3% and S&P500 down 1.5% for the month. Nvidia plummeted 8% on the 27th, just a day after their highly anticipated earnings release. The company’s stock gyrated a lot in February as markets tried to decipher the implications of Deepseek and the general development in AI.

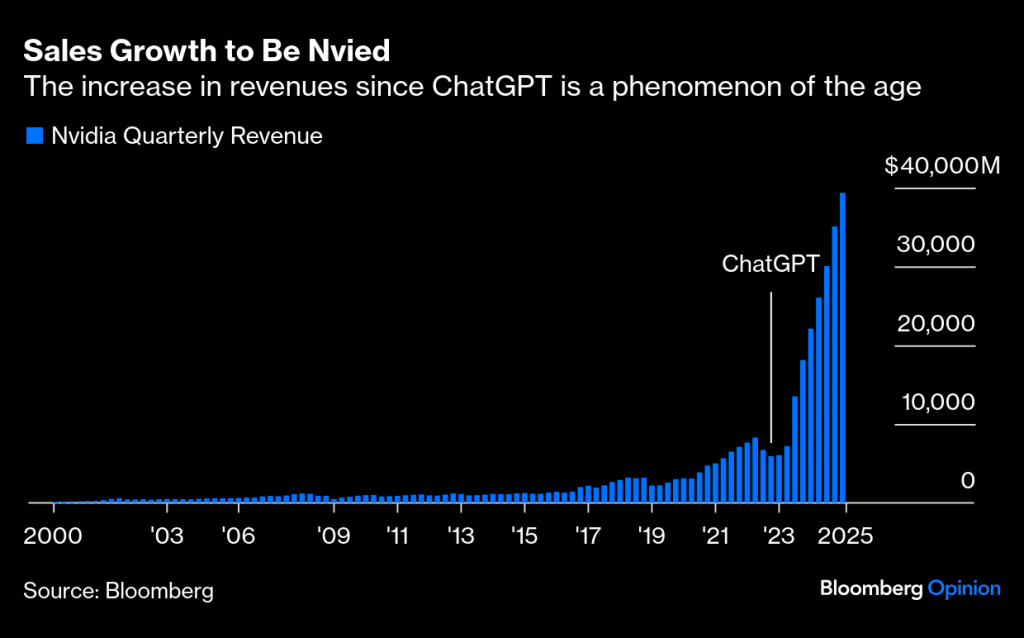

Nvidia: $40 Billion Quarter Shows Strength, With Warning Signs

Reporting just after market’s closed on Feb 25th, Nvidia blew past earnings expectations once again, announcing nearly $40 billion in revenue. Over 85% came from data centre demand driven by a strong market pull for the new Blackwell chips. CEO Jensen Huang attributed the growth to advances in reasoning models.

However, several concerning metrics emerged:

- Quarterly data centre (AI) revenue growth rates declined to 15.6% (versus 17.1% in the previous quarter).

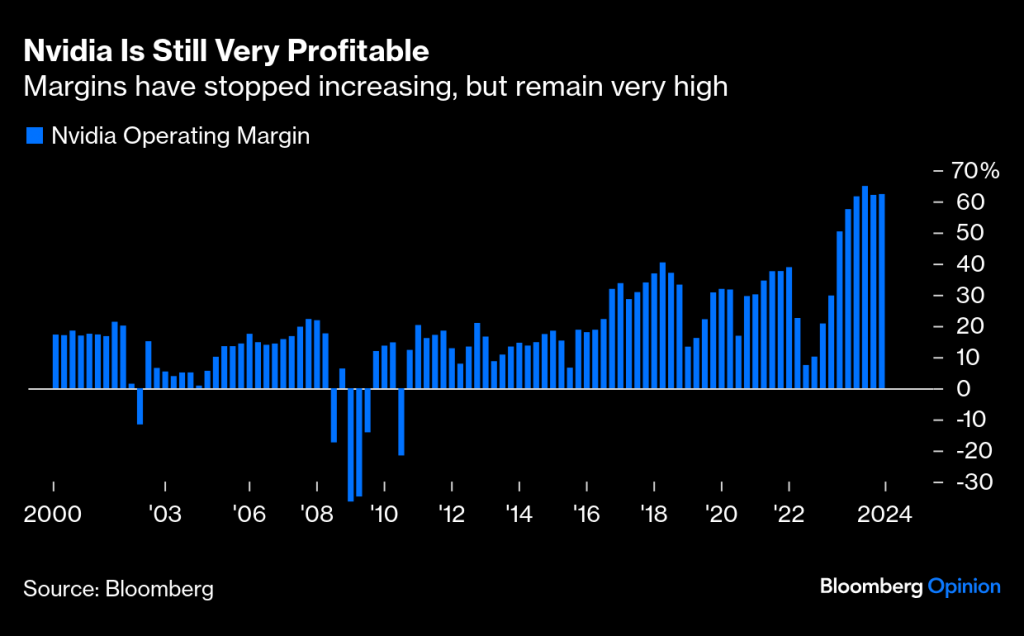

- Operating margin decreased for the second consecutive quarter (though still maintaining an extraordinary 60%+)

- The market is increasingly questioning whether Nvidia’s dominance in training can translate to inference workloads, where competitors like Groq are delivering better performance at lower costs.

These shifts suggest that even Nvidia’s seemingly impregnable moats may be showing signs of vulnerability.

The primary driver for Nvidia’s continued ascent remains hyperscaler capital expenditure (primarily Amazon, Google, Microsoft and Meta). To put this spending in context: from 2000-2016, total global data centre spending outside China averaged less than $10 billion annually (approximately $150 billion total for the period). In stark contrast, these four companies alone spent $260 billion on data centers in 2024, with Amazon explicitly committing to at least $100 billion for 2025.

However, potential moderation signals have emerged, with Microsoft cancelling two data centre leases and CEO Satya Nadella suggesting that he might slightly decelerate AI-related capital expenditure.

The AI Model Wars Intensify: Empire Strikes Back

After January’s shock arrival of DeepSeek’s r1 model, February had a distinct “Empire Strikes Back” feeling as the US frontier AI labs responded forcefully:

- OpenAI released GPT-4.5 to mixed reviews. Sam Altman himself acknowledged it’s “a giant, expensive model” that “won’t crush benchmarks.” At an estimated training cost of up to $500M and prohibitive pricing ($75/input and $150/output per million tokens—10-25x higher than competitors), the tech community remains divided. Half praise its improved “vibes” while the other half question whether any improvement could justify the astronomical costs.

- Elon Musk’s x.AI delivered the highly anticipated Grok 3, trained on Colossus – the world’s largest AI cluster (100,000 GPUs with further upgrades planned). And it is a truly impressive model.

- Anthropic released Claude 3.7 Sonnet with Claude Code – a transformative upgrade allowing the development of fully functional 3D video games from text prompts in under 5 minutes. The early assessment is that Anthropic once again has “the best” model for both coding and writing, showing that spending the most money doesn’t always lead to the best results.

The Deepseek team is planning their next move with Deepseek r2 scheduled for April.

Meanwhile, the funding wars for frontier AI models continue unabated:

- Anthropic is seeking $3.5 billion at a $60 billion valuation

- OpenAI is reportedly exploring raising $40 billion at a $300 billion valuation

- x.AI potentially targeting up to $10 billion at a $75 billion valuation

This overwhelming concentration of capital reflects a growing recognition of the prize that is at stake.

2025: The Year of Agentic AI and Scaling Skepticism

February further solidified 2025’s emerging identity as “the year of agentic AI” – systems that don’t merely respond to prompts but actively perform complex tasks with minimal supervision. It’s also becoming “the year of scaling skepticism,” as frontier labs burn billions on marginal improvements, leading many to question whether simply scaling existing architectures can deliver AGI. Deep Research and coding agents represent the most mature examples of the agentic transition, with the entire industry pivoting toward creating specialized agentic systems.

This transition is fundamentally changing how we think about software – from tools we use to agents that work for us. The implications extend beyond productivity gains to completely reimagining how digital work gets accomplished. Unlike previous AI advancements that enhanced existing workflows, agentic systems establish entirely new paradigms for human-computer interaction.

Increasingly, the value appears to be in the “wrapper”—the applications and specialized implementations rather than raw model capabilities. Companies that can effectively deploy AI to solve specific problems are seeing greater business impact than those chasing benchmark performance.

Critically, these agentic systems are now accelerating scientific discovery. Microsoft Research and DeepMind are deploying AI agents to advance quantum computing and fusion research respectively—creating the first strands of a powerful technological feedback loop.Beyond AI: Quantum and Fusion Breakthroughs

Microsoft’s Quantum Leap: Majorana 1

After 20 years of research, Microsoft unveiled the Majorana 1 chip – the world’s first quantum processor powered by a topological core architecture. In this context, topological means that the information stored in each qubit isn’t determine by a single (and fickle) particle, but rather by the shape (“topology”) of the relationships between two particles. These shapes are far more resilient than single particles. Therefore, this approach makes quantum computing more reliable and scalable by fundamentally changing how qubits are designed.

Traditional quantum computing faces a massive inefficiency problem: for every usable “logical” qubit, thousands of physical qubits are needed for error correction. Microsoft’s topological approach potentially reduces this ratio to 10-30 qubits per logical qubit, dramatically accelerating the timeline for practical quantum computing.

The implications are substantial across multiple domains:

- Cryptography: Future ability to crack current encryption standards

- Finance: Portfolio optimization through simultaneous evaluation of trillions of scenarios

- Supply chain: True optimization of complex multi-variable systems

- AI: Quantum machine learning could enable training models 100-1000x larger than today’s systems while using far less energy—a potential second-stage booster for AI advancement.

While commercially useful quantum computers (100+ logical qubits) could arrive by 2027-2030, cryptography-breaking capabilities likely still remain 10 years away, with scientific breakthrough applications in materials science and pharmaceuticals likely 15 years out.

France’s Fusion Milestone

Europe demonstrated its technical prowess with a significant energy breakthrough in February. The French CEA’s West Tokamak reactor sustained fusion for 22 minutes – surpassing China’s 17-minute record set just a month earlier.

The achievement represents a crucial step toward sustainable fusion energy, where a single gram of hydrogen isotopes can yield energy equivalent to 11 tons of coal. The key challenge isn’t fusion itself but maintaining plasma stability at temperatures of 100-150 million Celsius without damaging the reactor.

What’s particularly striking is how AI is turbocharging fusion research. AI research by group’s like DeepMind’s is optimizing plasma containment—forming the third pillar of our technological trinity. As fusion approaches commercial reality, it promises the abundant clean energy needed to power ever-more-sophisticated AI and quantum systems.

The roadmap to commercial fusion includes:

- Achieving continuous net energy gain (more energy out than in)

- Extending operation from minutes to days/weeks/months

- Developing materials durable enough to withstand extreme temperatures

- Addressing fuel cycle challenges with deuterium and tritium

While commercial rollout remains decades away (likely 2040s), the accelerating pace of milestones suggests the traditional “fusion is always 40 years away” joke may finally be obsolete. The prospect of abundant clean energy within 15-20 years would fundamentally reshape our economic and environmental outlook.

The Virtuous Cycle: How Three Revolutions Reinforce Each Other

The developments of February 2025 reveal a clear pattern of technological co-evolution:

- AI → Quantum: Advanced AI systems are designing quantum architectures and optimizing error correction techniques that human researchers couldn’t discover alone

- Quantum → AI: The first quantum-accelerated machine learning algorithms are showing 10-100x improvements in training efficiency

- AI → Fusion: AI-powered plasma simulation and real-time control systems are solving containment challenges that have stymied fusion for decades

- Fusion → AI/Quantum: As fusion approaches commercial viability, it promises to provide the massive energy resources needed for next-generation computing at sustainable costs

This virtuous cycle creates a technological acceleration feedback loop, unlike anything in human history. Each breakthrough in one domain catalyzes advances in the others, potentially leading to exponential progress across all three fields.

Europe at a Crossroads

The Munich Security Conference in February sparked considerable debate about Europe’s future. US Vice President JD Vance delivered remarks that many Europeans found provocative, suggesting Europe’s greatest threats come from within rather than from external adversaries like Russia.

Though the timing and delivery were debatable, there’s merit in European self-reflection. The European economy is more than 10 times larger than Russia’s, and even the UK alone maintains a larger manufacturing base than Russia. This mismatch in economic scale suggests Europe has the fundamental capacity to secure its own prosperity and defence.

Europe’s challenges stem primarily from governance and productivity issues. The NHS in the UK has seen productivity decline by 20% over the past five years (when measuring output per inflation-adjusted £ spent) – yet this also represents an opportunity. Determined investment in AI could substantially improve productivity and free up resources for reinvestment elsewhere.

Europe’s position in the emerging technological trinity is particularly precarious. While it has made significant strides in fusion research, it lags considerably in both AI and quantum computing development. Without concerted investment in these areas, Europe risks becoming merely a consumer rather than a producer of the most transformative technologies of our time.

The question remains whether Europe will seize this moment to strengthen its technological and defence capabilities or continue clinging on to US support that appears increasingly uncertain.

Forward look for the next three months

Several critical developments bear watching in the coming months:

- AI Releases: GPT-5 arriving as early as May, though OpenAI’s admission of being “out of GPUs” and the launch of their massive “Stargate” cluster suggests potential delays.

- Regulatory Landscape: The EU’s Artificial Intelligence Act is now active with potential enforcement actions against “high-risk” AI systems, while US states implement their own frameworks.

- Geopolitical Dynamics: Potential steps toward resolution in Ukraine and potential global trade disruption from Trump’s tariff rhetoric.

- Market Liquidity: Signs of improving IPO and M&A environments could drive more exits and recycling of capital.

- Cross-Domain Collaborations: Watch for announcements of major collaborations between AI, quantum, and fusion research organizations—these partnerships will accelerate the virtuous cycle.

- Energy Infrastructure: Major data center providers are beginning to announce long-term power purchase agreements with fusion energy startups, signaling confidence in the technology’s commercial timeline.

- AI Efficiency Revolution: Watch for companies focused on inference optimization and specialized hardware that can deliver AI capabilities at lower costs—potentially challenging Nvidia’s dominance.

For venture capital, 2025 appears positioned as a solid year. The excesses of 2021-2022 have largely been purged from the system, while AI continues to fuel significant investment opportunities across verticals.

SuperSeed Portfolio Alignment

Several SuperSeed portfolio companies are directly positioned to capitalize on current trends:

- Hirundo: Their AI optimization, “unlearning”, and bias-removing technology addresses the growing need for explainable, compliant AI models as regulatory frameworks mature.

- Messium: Their hyperspectral satellite imagery combined with AI for optimizing agricultural fertilization aligns with the increasing demand for sustainable, precise agriculture

- Tector: Their AI-powered construction defect detection (reducing costs by up to 3%) demonstrates how AI can transform traditional industries

- Octaipipe: Their AI solution for data centre energy optimization addresses a critical need as AI infrastructure power.

The convergence of AI capabilities with specialized domain expertise across these companies represents exactly the type of vertical applications that will drive the next phase of AI value creation.

As we progress further into 2025, the distinction between purely speculative AI plays and those delivering tangible operational value will become increasingly important. Companies that can demonstrate clear ROI metrics and integration with existing workflows will gain disproportionate attention from both customers and investors.