Growth for SaaS companies is back in vogue!

Wait, what?

As we know, 2022 was the year when an all-consuming focus on growth was replaced by sensible business. Positive unit economics. Free Cash Flows. Those sorts of grown-up things.

I’ll come back to that in a minute. First, let’s look at the macro picture around the valuation of tech stocks.

2022 was an abysmal year for most investors. The S&P500 closed down ~20%, with all almost all sectors battered (energy being the only exception).

But why are stocks down even though company performance was respectable? It's true; Q4 earnings haven't been released yet. But the expectation is that 2022 revenue and profit are both up for SP500 as a whole.

So although both profits and revenues were up, each profit $ is now valued less by investors. And valuation multiples (price-to-revenue and price-to-earnings) reflect this.

As you can see, the multiple decline has touched all sectors. Even energy. But energy stocks are up because increases in energy sector profits have more than outweighed multiple compression.

What's happening with SaaS companies?

From 2018, the overriding driver of SaaS company valuation was revenue growth. Higher growth rates led to higher valuation multiples. Investors paid little attention to unit economics and profitability.

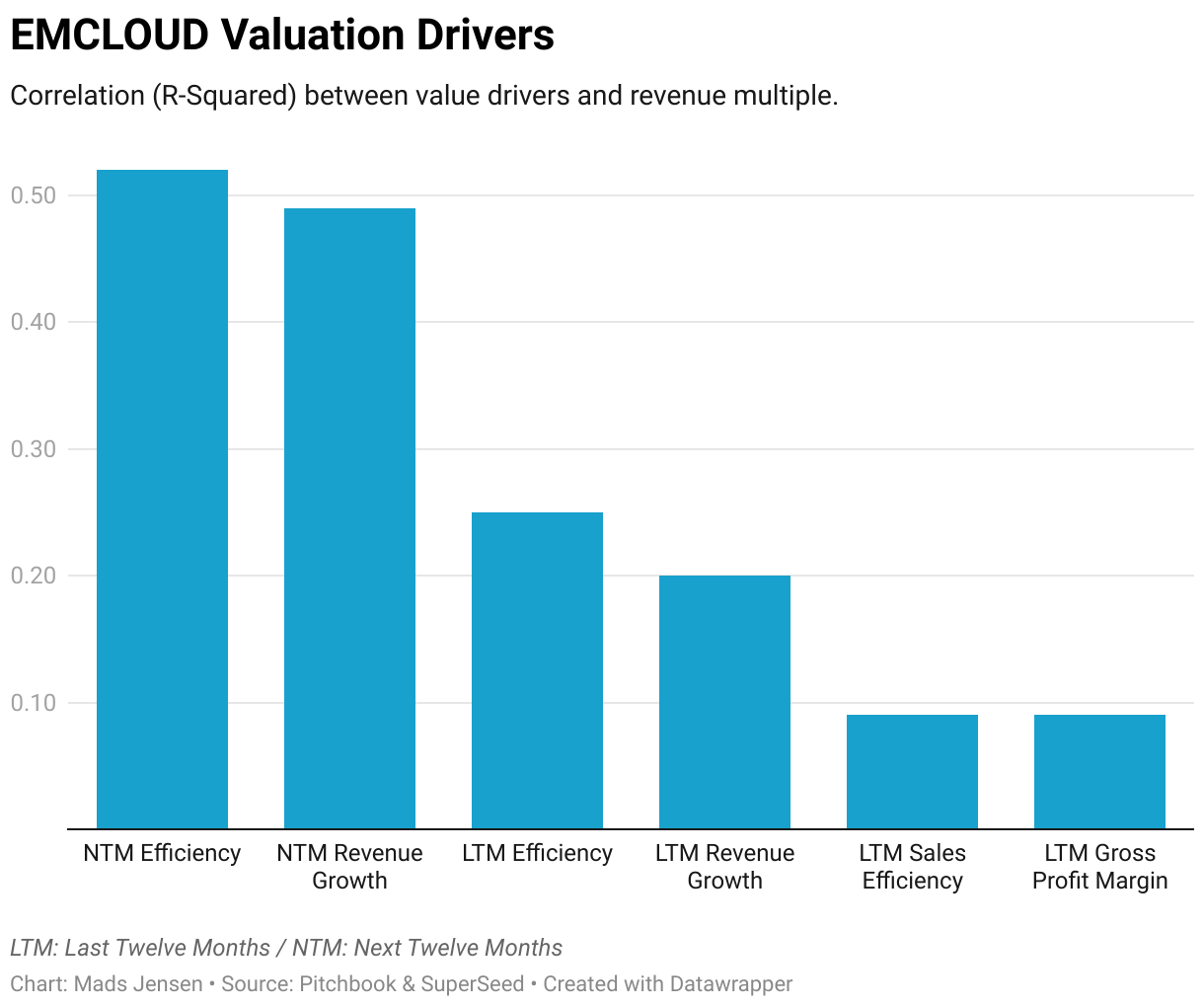

This changed dramatically in 2022. Growth went from explaining 50-60% of a company's valuation to less than 30%. Meanwhile, the Efficiency metric increased in importance. Efficiency is a measure that combines Revenue Growth with Free Cash Flow. It tells us how efficient growth companies are at turning cash into growth. And by March 2022, Efficiency had become the most important metric to value companies.

How does the scorecard look at the beginning of 2023?

For this analysis, I use the Bessemer EMCLOUD index as a proxy for SaaS companies. It consists of 75 well know, public cloud companies. Category software leaders like Salesforce, Adobe, Atlassian and Datadog.

But even these industry-leading software companies are, on average, still losing money. Of the 75 firms in the index, only 13 have reported positive net income over the past 12 months.

So why are they valuable? For one, they are still growing rapidly. And once they achieve scale, they can become exceptionally profitable. Take Adobe. The design software behemoth has delivered $7bn of Free Cash Flow on $17.6bn of revenue over the past year. A Free Cash Flow margin in excess of 40% is what most companies can only dream of.

And because of these economics, fast-growing software companies can be highly valuable. Witness Adobe's acquisition of Figma for $20bn in September. The deal was done at 50x annual recurring revenue. There is still a lot of money in growth.

SaaS vs. S&P500 Growth

Back to EMCLOUD: The median company grew 33.2% over the past year. And is forecasted to grow 25.6% over the next 12 months.

This compares to the median S&P500 company that is projected to grow 6.4% in the next 12 months.

In 2022, the median EMCLOUD company revenue multiple declined from 17x to 6.6x. But it is still 2.5x higher than the median S&P500 company at 2.6x. There is indeed value in growth.

S&P500 valuations as we enter 2023

So what is the simplest way to accurately determine the value of a public software company as we enter 2023?

Let's start by looking at the large-caps from S&P500. For those, profitability is the main driver. EBIT Margin explains more than 40% of a valuation multiple. This is followed by Free Cash Flow Margin and Gross Profit Margin. Net Income on its own is a relatively poor predictor. And importantly, it is all about the forecasted profitability. Future expectations are much better at predicting the share price than past performance.

Public SaaS valuations at the start of 2023

How well does with work for SaaS companies? As mentioned, most of the EMCLOUD companies have negative net income. That would lead to negative valuation multiples - not useful.

As a result, profitability is a poor predictor of SaaS company value. But Efficiency (growth + Free Cash Flow) is a great one. And forecasted Efficiency for the next year alone explains 52% of a company's revenue multiple.

If you are looking for a simple revenue multiple, the best predictor is next year's forecasted Efficiency. This is closely followed by forecasted revenue growth.

Note that there is almost no overlap between how the market values S&P500 and SaaS companies.

Growth by itself was in the dog house last year. It is now again at a point where it explains nearly half of a SaaS company's valuation. That's a meaningful change.

Note: in my view, this doesn't mean that we are back to growth at all costs. 2023 will be a year of continued "fiscal discipline" in startup land. But growth continues to be extremely important for value creation.

What does this mean for private companies?

Strong early-stage SaaS companies grow much faster than large, listed companies. So if growth is valuable, they should be even more valuable.

But there are detractors to that valuation premium.

- Yes, early-stage companies are full of potential. They are also full of risk. Market risk. Execution risk. Founder risk. All things that can railroad them well before they hit $100m in ARR. So what matters is the long-term growth rate as they grow into their Total Addressable Market.

- Illiquidity premium. In the past few years, it was fashionable to see liquidity as old-fashioned. Who cares about liquidity when there is plenty of Quantitive Easing cash? But now interest rates are higher, and volatility is up. And it's useful to be able to sell shares if you need liquidity. Private companies don't offer that option - at least not easily. Therefore they should be priced at a discount to public companies, all else being equal.

Valuing private companies is still as much art as it is science. But it is helpful to pay attention to how public companies value SaaS businesses. And interesting to see how this changes over time.