This is not investment advice.

The Nasdaq 100 has plummeted 13% from its February peak, with the Magnificent 7 tech stocks haemorrhaging $2.7 trillion in market capitalisation since January—equivalent to the UK’s entire annual Gross Domestic Product (GDP). This market correction, which we predicted in our 2025 Crystal Ball (“The S&P 500 will undergo a major correction”), arrives at the intersection of two significant disruptive forces: Chinese AI startup DeepSeek’s highly efficient models challenging established AI infrastructure economics, and the Trump administration’s aggressive tariff implementation sending ripples through global supply chains. Only ten weeks into Trump’s second term, markets are struggling to digest both technological disruption and policy volatility—raising the central question: Is AI uncertainty finally hitting markets, or is this merely a temporary correction in a longer growth trajectory?

This month, we examine this volatile intersection of technology and policy. How deeply will the AI infrastructure boom be affected by efficiency innovations and market corrections? How will Trump’s tariff regime reshape technology manufacturing and investment? And amid market volatility, can we separate short-term fluctuations from the fundamental transformation AI continues to drive across industries?

Market Analysis: The Correction Arrives as AI Economics Face Scrutiny

The S&P 500 has retreated 5% in Q1 2025 and is down 9% from its February peak, while the Nasdaq 100’s 13% decline reflects technology’s disproportionate vulnerability to current market forces. This correction has carved $2.7 trillion from the Magnificent 7 alone, with Tesla dropping 40% and Nvidia experiencing a 16% single-day plunge in late January. This downturn reflects both broad market recalibration and targeted questions about near-term AI infrastructure investment returns.

The market turbulence unfolds against a backdrop of extreme concentration—the top 10 US stocks now comprise 40% of the S&P 500’s $20.9 trillion value, exceeding the entire European market by $4.9 trillion. In our January analysis, we highlighted this concentration as unsustainable, and the market correction has largely followed the trajectory we anticipated in our 2025 Crystal Ball.

CoreWeave’s March 28 Initial Public Offering (IPO) offers an illuminating case study of the current climate. Priced at $40—below the initial $47-$55 range—the shares opened at $39 and closed flat. While raising $1.5 billion remains impressive, falling short of the targeted $2.7 billion reflects both general market conditions and company-specific concerns. CoreWeave’s 62% revenue dependence on Microsoft presents concentration risk, and launching into a declining market creates additional headwinds regardless of sector.

The fundamental question facing investors remains: Is the market reaction to DeepSeek’s efficiency breakthrough overblown? While DeepSeek demonstrated AI models comparable to Western counterparts at approximately 5% of the training cost—triggering Nvidia’s $600 billion market capitalisation reduction in January—this tells only half the story. The other half lies in AI adoption and deployment scale. Only 6% of US companies have implemented significant AI capabilities to date, suggesting we remain in early adoption stages. As Nvidia CEO Jensen Huang noted at the company’s annual Graphics Technology Conference (GTC), he now sees the inference market as 100 times larger than projected just twelve months ago, driven by reasoning models that require massive inference capacity.

Macroeconomic Indicators: Tariff-Driven Inflation Threatens Monetary Policy Balance

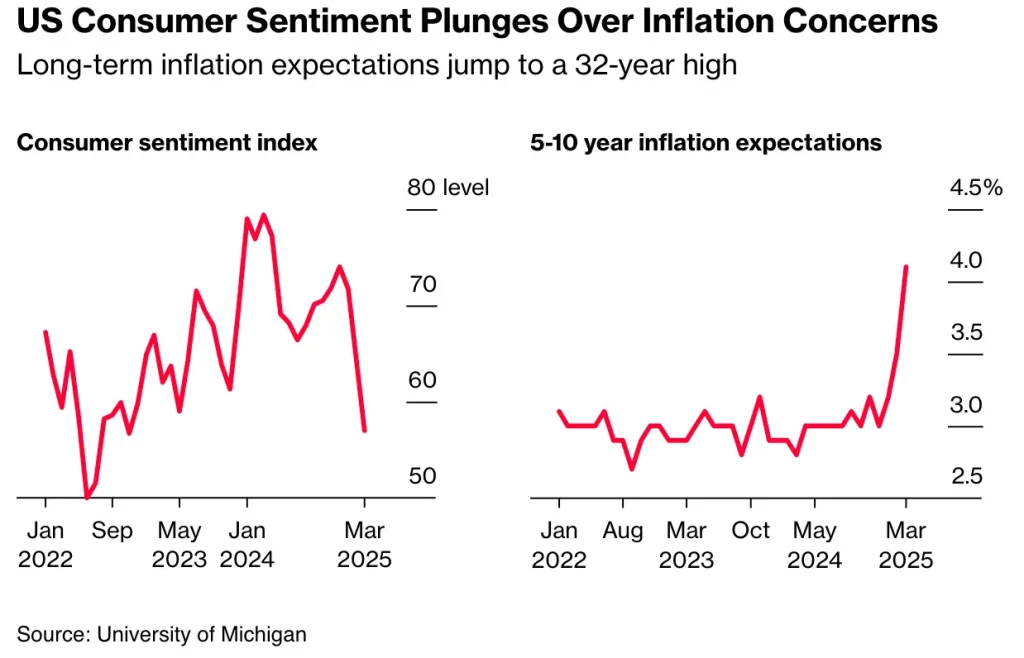

US inflation remains stubbornly elevated at 2.5% in Q1 2025, up from 2.3% in Q4 2024, while the Eurozone Consumer Price Index (CPI) holds at 2.2%. The Federal Reserve has consequently paused its rate-cutting cycle after December’s trim, with futures markets now pricing just one cut for 2025. The 10-year Treasury yield has climbed to 4.62% from 3.63% in September 2024, reflecting persistent inflation expectations.

The Trump administration’s tariff implementation has progressed from rhetoric to reality with alarming speed:

- 25% tariffs on auto imports effective April 2, 2025

- 25% “reciprocal tariffs” on 15% of US trade partners (April 2, 2025)

- 25%+ threatened on EU goods (April 15, 2025)

- 25% global steel and aluminium tariffs (effective March 12)

- 20% on all Chinese goods (up from 10%)

A Reuters/Ipsos poll shows 57% of Americans—including 33% of Republicans—consider these tariff policies “unsteady,” with 70% anticipating higher consumer prices. This economic uncertainty has pushed the Economic Policy Uncertainty Index to levels not seen since the COVID-19 pandemic.

The European Central Bank (ECB) has diverged from the Federal Reserve, cutting rates on March 14 while maintaining cautious forward guidance. This policy divergence has strengthened the dollar (EUR/USD at 1.10), creating opposing forces for technology companies—US-based firms benefit from currency strength for acquisitions, while European startups face headwinds when competing globally.

The timing of these economic policies may be more strategic than haphazard. The US administration appears willing to absorb economic turbulence early in the term, potentially creating runway for recovery before the 2026 midterm elections. As Trump recently stated, he’s “not that bothered about the stock market” at this stage of his presidency—a remarkable shift from his first term’s focus on market performance as a barometer of success.

Technology & AI Focus: Efficiency Revolution Reshapes the Landscape

DeepSeek’s January breakthrough continues reverberating through the AI industry. The Chinese company has since released a further update to their v3 model that fully rivals Western counterparts in capability while maintaining their open-source approach. Their initial innovation demonstrated competitive AI model performance with approximately $6 million in training costs—roughly 1/20th of the industry standard $100+ million investment. Their approach wasn’t merely frugal; it represented fundamental architectural innovation:

- Efficient Training Architecture: Using fewer decimal places for calculations, reducing memory requirements by 75%

- Multi-Token Prediction: Forecasting multiple words simultaneously with 85-90% accuracy, doubling inference speed

- Mixture-of-Experts (MoE): Selectively activating only necessary parameters (37 billion from a 671 billion parameter model) for each specific task

This efficiency revolution has triggered an arms race among Western frontier AI companies:

- OpenAI is reportedly raising $40 billion at a $300 billion valuation, led by SoftBank, while developing GPT-5 (expected May 2025)

- Anthropic released Claude 3.7 Sonnet with Claude Code, enabling full 3D video game development from text prompts in under 5 minutes

- Elon Musk’s xAI delivered Grok 3, trained on the massive Colossus cluster (100,000 Graphics Processing Units). What makes Grok 3 particularly significant is its real-time access to the X social media feed, giving it unmatched capability to take the world’s pulse at any given moment—a competitive advantage no other model can currently replicate

- Google has dramatically reversed its fortunes with Gemini 2.5, leapfrogging from laggard to leader. After spending much of 2024 on the back foot, Google now sits neck-and-neck with Anthropic as the technical community’s favourite model

2025 has emerged as “the year of agentic Artificial Intelligence”—systems that autonomously perform complex tasks rather than merely responding to prompts. This shift fundamentally transforms how we conceptualise software, evolving from tools we operate to agents that work independently on our behalf. The distinction is comparable to having a chauffeur instead of driving yourself—the vehicle remains the same, but the experience and productivity implications differ dramatically.

Creative applications continue showcasing AI’s expanding capabilities. OpenAI’s integration of advanced image generation directly into ChatGPT has sparked the viral “Studio Ghibli” aesthetic trend. This remarkable Lord of the Rings trailer created entirely with AI in Ghibli style demonstrates the creative frontier:

See the full video here.

Beyond these consumer-facing applications, energy constraints have emerged as a critical bottleneck. The European Data Center Association reports 75% of operators cite electricity access as their primary concern. In Ireland, data centres already consume 20% of the country’s electricity—projected to reach 30% within three years. This energy challenge makes efficiency innovations like DeepSeek’s not merely economically advantageous but potentially essential for AI’s continued expansion. Equally important, it highlights the massive opportunity in AI applications, particularly in the physical world, where efficiency and specialised implementation will likely drive the next wave of value creation.

AI Applications: The Next Frontier Beyond Infrastructure

While the market reassesses AI infrastructure investments, the application layer continues showing tremendous promise. As we covered extensively in last month’s analysis of the “Technology Trinity” (AI, quantum computing, and fusion energy), these converging domains are creating unprecedented innovation opportunities. Rather than repeating those insights, we’ll focus this month on how the AI efficiency revolution is accelerating application development.

The efficiency gains demonstrated by DeepSeek don’t diminish AI’s transformative potential—they actually expand it by democratising access. Lower training and inference costs enable more organisations to implement AI solutions, potentially broadening the addressable market substantially. This is particularly significant for vertical applications in traditional industries like manufacturing, healthcare, agriculture, and logistics, where implementation costs have been a primary adoption barrier.

The physical world represents AI’s next major frontier. While the first wave focused on digital domains (language processing, image generation, coding assistance), the emerging opportunity lies in connecting AI to the physical world through sensors, robotics, and industrial systems. These applications require not just powerful models but specialised implementation and domain expertise—areas where both established companies and startups can create defensible advantages.

European Tech Landscape: Manufacturing Challenges Amid Defense Opportunities

European automakers face existential pressure from multiple directions: Chinese electric vehicles at significantly lower price points (€20,000 vs. €60,000) and now US tariffs threatening export markets. German manufacturers appear particularly vulnerable, with Volkswagen producing approximately 500,000 vehicles annually in Mexico that would face new tariffs. Mercedes has already seen Chinese sales “fall through the floor,” compounding challenges across their key markets.

Amid this manufacturing turmoil, European technology presents a more promising picture. SAP has emerged as Europe’s most valuable company, overtaking Danish pharmaceutical giant Novo Nordisk. The German enterprise software giant now trades at 40 times forward Price-to-Earnings ratio—exceeding even Nvidia’s multiple. This valuation reflects growing recognition of SAP’s extensive data assets and enterprise AI potential.

The US-Europe relationship is experiencing its most significant strain since the Iraq War era. European defence procurement is undergoing reconsideration, with countries cancelling or postponing orders for American systems like the F-35 fighter jet. European nations are rapidly increasing defence budgets in response to perceived US unreliability, with Germany’s newly elected chancellor removing the borrowing cap to increase defence spending to 3.5% of GDP before 2027.

This defence pivot creates an unexpected opportunity for European manufacturers, particularly in Germany. Just as automotive demand faces pressure, defence manufacturing presents an alternative utilisation path for Europe’s industrial base. Germany’s manufacturing sector alone is 3.5 times larger than Russia’s entire manufacturing output. If Europe commits to supporting Ukrainian independence and countering Russian aggression, its industrial capacity is more than sufficient for the task—a form of “weaponised Keynesianism” that could maintain manufacturing employment while serving strategic objectives.

The European defence budget, currently estimated at approximately €400 billion annually (including the UK), is projected to reach €500-600 billion within three years. This surge creates substantial market potential for European defence technologies, particularly in drone systems, autonomous vehicles, and cybersecurity—all areas where AI applications can deliver significant advantages.

Venture Capital Landscape: Exit Windows Reopen Amid Market Volatility

Exit activity shows encouraging signs after a two-year drought, with both IPOs and Mergers and Acquisitions (M&A) accelerating in Q1 2025. Google’s acquisition of Israeli cybersecurity firm Wiz for $32 billion represents the most valuable M&A transaction for a venture-backed private company in history, exceeding Meta’s $19 billion WhatsApp purchase in 2014. The deal’s $3.5 billion break fee underscores both regulatory uncertainty surrounding large technology acquisitions and Google’s confidence in completing the transaction under the Trump administration’s more business-friendly approach to antitrust.

The IPO pipeline has strengthened substantially, with more than 70 listings in the US during Q1 2025—90% above the same period last year. However, CoreWeave’s underwhelming debut demonstrates that while the window has reopened, investor discipline remains intact. Notably, Klarna is filing a revised F1, targeting a $15 billion valuation and planning to raise over $1 billion. While representing a substantial decrease from its 2021 peak of $45 billion, this offering signals a returning appetite for European fintech listings.

Cerebras’s IPO remains in regulatory limbo, awaiting the Committee on Foreign Investment in the United States (CFIUS) review regarding G42’s $335 million stake. Approval could materialise by May if Trump’s team provides clearance; otherwise, the process extends into Q3. With a projected $4.25 billion valuation, this AI chip manufacturer’s massive wafer-scale technology represents another critical test of market sentiment toward infrastructure plays.

The Cerebras situation highlights the fascinating competitive dynamics emerging in AI hardware. While Nvidia dominates the training market with its Graphics Processing Units (GPUs), specialised players like Cerebras and Groq are mounting serious challenges in the inference market. This battle between the $2+ trillion incumbent and nimble upstarts showcases how quickly the competitive landscape can evolve in AI—Cerebras was founded just seven years ago, yet its wafer-scale engine technology now stands as a credible alternative to Nvidia’s H100 for certain workloads. Similarly, Groq’s compiler-focused approach delivers speed advantages for specific applications. These specialised approaches may not dethrone Nvidia broadly, but they demonstrate how innovation continues creating opportunities even in hardware markets with seemingly entrenched leaders.

Looking Ahead: Strategic Implications for Q2 2025

Several critical developments warrant close monitoring in Q2:

- Frontier AI Releases: OpenAI’s GPT-5 could arrive by May, though competing priorities and hardware constraints might delay launch. The model’s capabilities and efficiency improvements will provide crucial signals about AI’s development trajectory.

- Regulatory Environment: The European Union’s Artificial Intelligence Act enforcement begins affecting high-risk systems, potentially creating compliance burdens for technology firms while establishing clearer operational parameters.

- Tariff Implementation: April’s scheduled tariff implementation will provide concrete evidence of economic impacts, potentially moderating through negotiated exceptions or intensifying through retaliatory measures.

- Energy Infrastructure: Major data centre providers are negotiating long-term power purchase agreements to secure capacity. Watch for announcements about innovative approaches to energy supply, potentially including smaller-scale nuclear installations.

- Specialised AI Hardware Competition: The showdown between Nvidia and challengers like Cerebras and Groq represents a fascinating case study in market disruption. While Nvidia’s H100 and upcoming Blackwell chips remain the gold standard for training, these specialised players offer compelling advantages for inference workloads. Their progress will signal whether AI hardware follows historical patterns where specialised solutions eventually gain ground against general-purpose incumbents.

Despite recent market volatility, 2025 maintains strong fundamentals for technology investment. The efficiency revolution triggered by DeepSeek doesn’t diminish AI’s transformative potential—it expands it by democratising access. Lower training and inference costs enable broader implementation across industries, potentially accelerating adoption beyond the current 6% of US companies utilising significant AI capabilities.

This dynamic echoes historical technology adoption patterns. When personal computers dropped below $1,000, enterprise adoption accelerated dramatically. When cloud computing costs declined by 50% between 2010-2015, Software-as-a-Service implementations surged. Similarly, AI’s efficiency revolution won’t reduce the overall market opportunity—it will likely expand it substantially by bringing capabilities within reach of organisations previously priced out of serious implementation.

Returning to our opening question: Is AI uncertainty hitting markets? Certainly, the near-term economics of AI infrastructure face legitimate scrutiny. However, the broader transformation continues unabated.

This reality creates particularly compelling opportunities in Europe, where early-stage valuations remain approximately 50% below US comparables despite comparable technical talent. The region encompassing London, Cambridge, and Oxford continues to represent one of the world’s strongest talent concentrations in AI and deep technology. This combination of talent density and reasonable valuations offers exceptional risk-reward profiles for investors willing to look beyond the market’s current infrastructure fixation toward application-focused innovation.

The real risk isn’t overestimating AI’s impact but underestimating how efficiency innovations will accelerate adoption across industries. For SuperSeed and our portfolio companies, this environment richly rewards what early-stage innovation does best: creating differentiated technology that delivers clear value through specialised implementation in high-impact domains.

As Q2 unfolds, we’ll be watching the evolving economics of AI applications more closely than infrastructure valuations. While market corrections grab headlines, the less visible but more profound story remains how these transformative technologies are reshaping industries from manufacturing to healthcare, logistics to agriculture. The companies that thrive will be those focusing not on hype cycles but on tangible value creation—precisely where European technical talent and more reasonable valuations offer compelling advantages in this next phase of technological transformation.