10 Developments That Transformed Technology and Markets in 2024

The technology industry’s centre of gravity shifted dramatically in 2024, driven by massive capital deployment into AI infrastructure and fundamental market realignments. Here’s how ten key developments reshaped our landscape:

1. The AI Arms Race Triggered a Massive Capital Mobilization

2024 marked an unprecedented mobilisation of capital and computing power. The numbers tell the story: Over $40 billion poured into foundation model companies, with single raises reaching stunning levels. X-AI secured $11 billion and built Colossus—connecting 100,000 Nvidia processors in just 18 days. Microsoft countered with a $30 billion commitment for 485,000 processors.

This arms race made Nvidia the definitive kingmaker. Its stock surged 170% as the world’s largest tech companies competed for limited chip supply. By year’s end, computing infrastructure had become the primary constraint on AI advancement, creating a new form of strategic leverage in the tech industry.

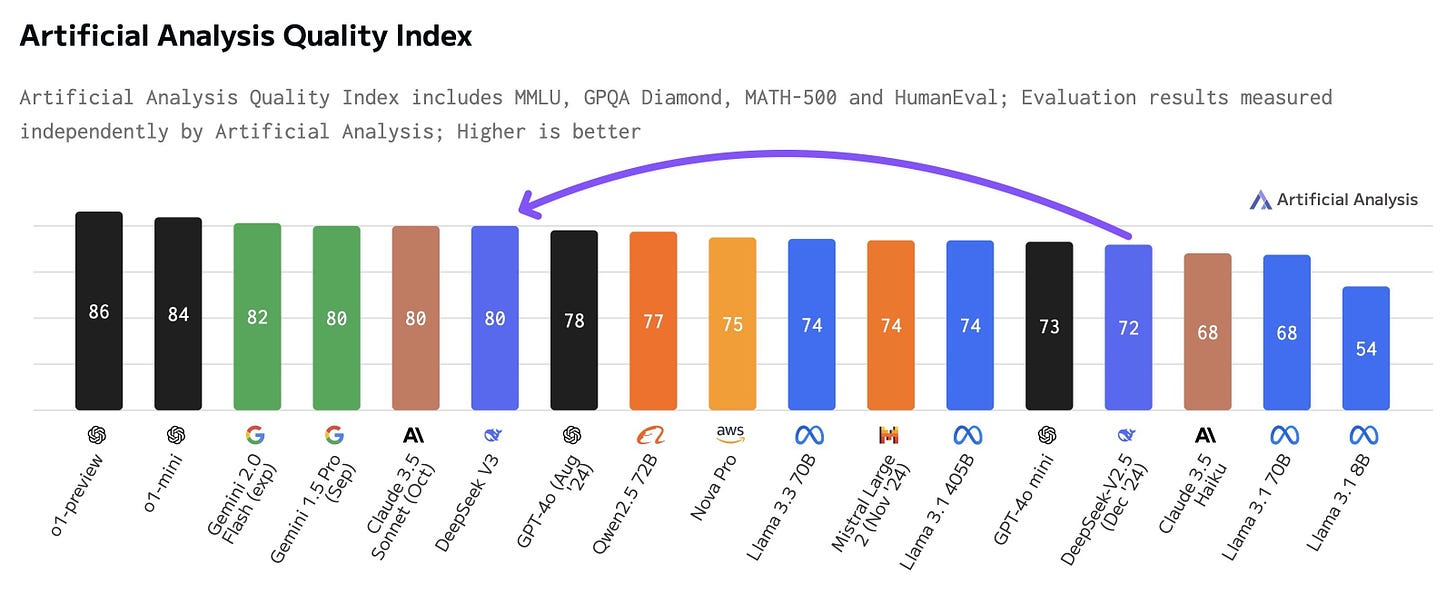

2. DeepSeek Rewrote the AI Economics Playbook

In December, a Chinese company called DeepSeek achieved what many thought impossible: building a top-tier AI model for just $5-6 million—a fraction of the billions spent by Western companies. Their breakthrough wasn’t just cost-cutting; they fundamentally reimagined how AI systems process information.

Think of traditional AI models as cities with inefficient transport systems—data has to travel through every district to reach its destination. DeepSeek built express lanes and smart traffic management, allowing information to flow more directly. They also created specialised “experts” within the system that handle specific types of problems rather than running everything through a single massive neural network.

The result? A model that matches or exceeds Western competitors while using just 1% of the resources. This isn’t just about cost savings—it points to a future where AI development becomes dramatically more accessible.

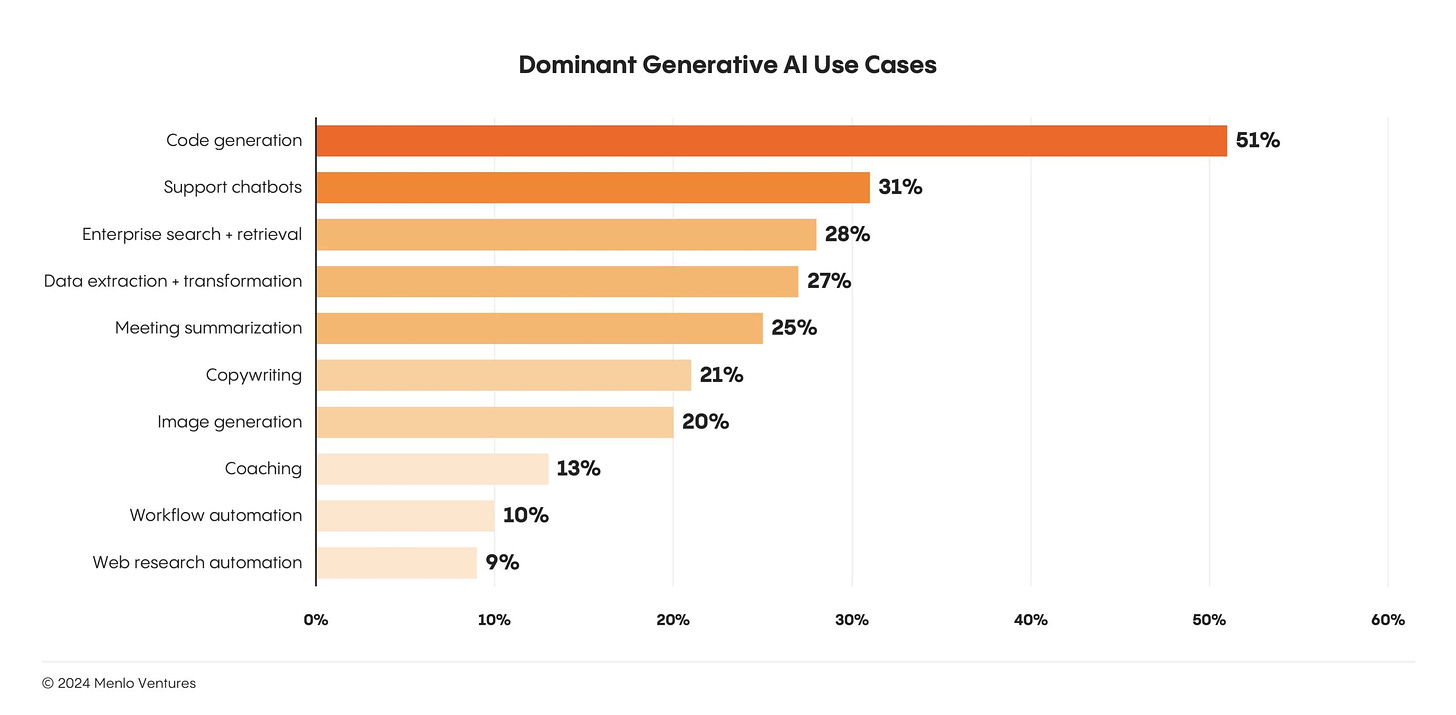

3. Enterprise AI Delivered Real Wins (And Some Spectacular Failures)

The enterprise AI story in 2024 was more complex than simple success or failure. Yes, there were high-profile mishaps—IBM’s AI adding McNuggets to every McDonald’s order and Google’s search hallucinations. But look at the wins:

- Waymo matched Lyft’s market share in San Francisco (22% each), proving autonomous vehicles can compete at scale

- GitHub Copilot reached over 1.2 million paid users by spring, demonstrating widespread developer adoption

- Cursor hit $50M annual recurring revenue in just 18 months

- Klarna’s AI customer service assistant handled 2.3 million conversations in its first month, cutting resolution times from 11 to 2 minutes and matching the output of 700 full-time agents

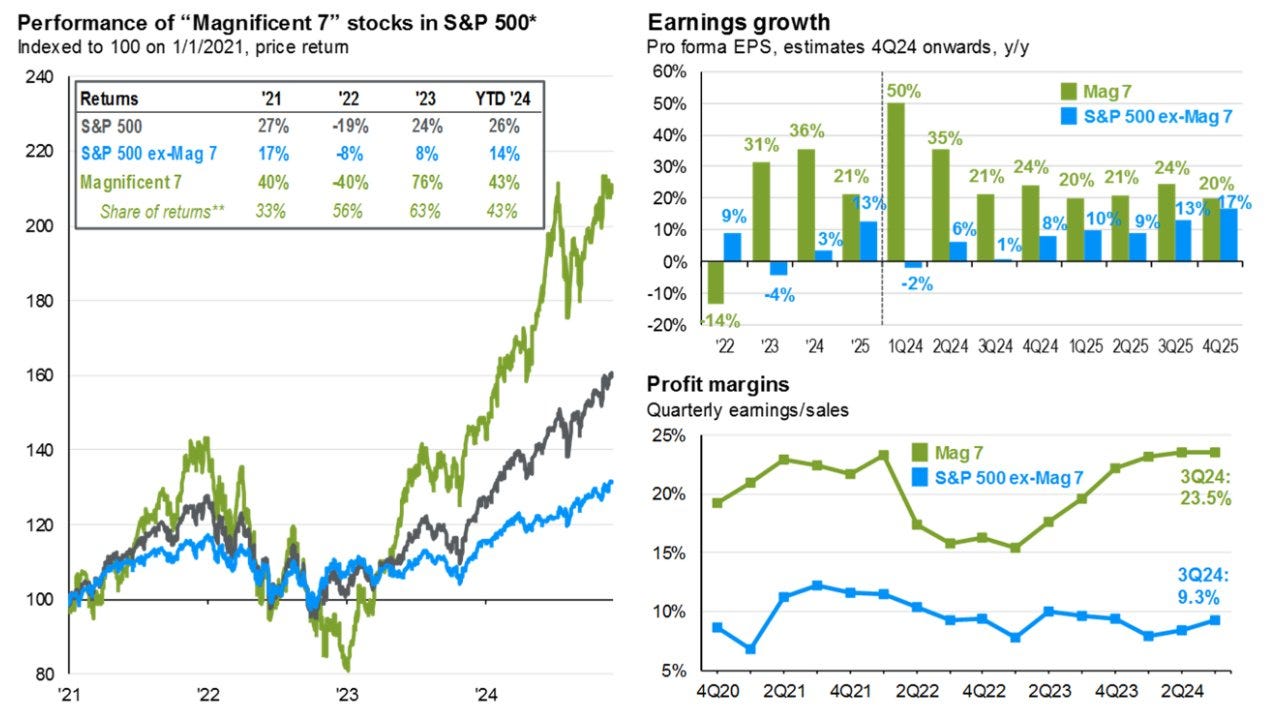

4. Market Bifurcation Intensifies

The Magnificent 7 tech leaders achieved 43% share price growth in 2024, dramatically outperforming the remainder of the S&P 500’s 14% increase. This bifurcation reflects the market’s recognition of AI’s transformative impact on enterprise value creation. The divergence highlights how AI capabilities are becoming the primary driver of market valuations.

5. Transatlantic Growth Divergence

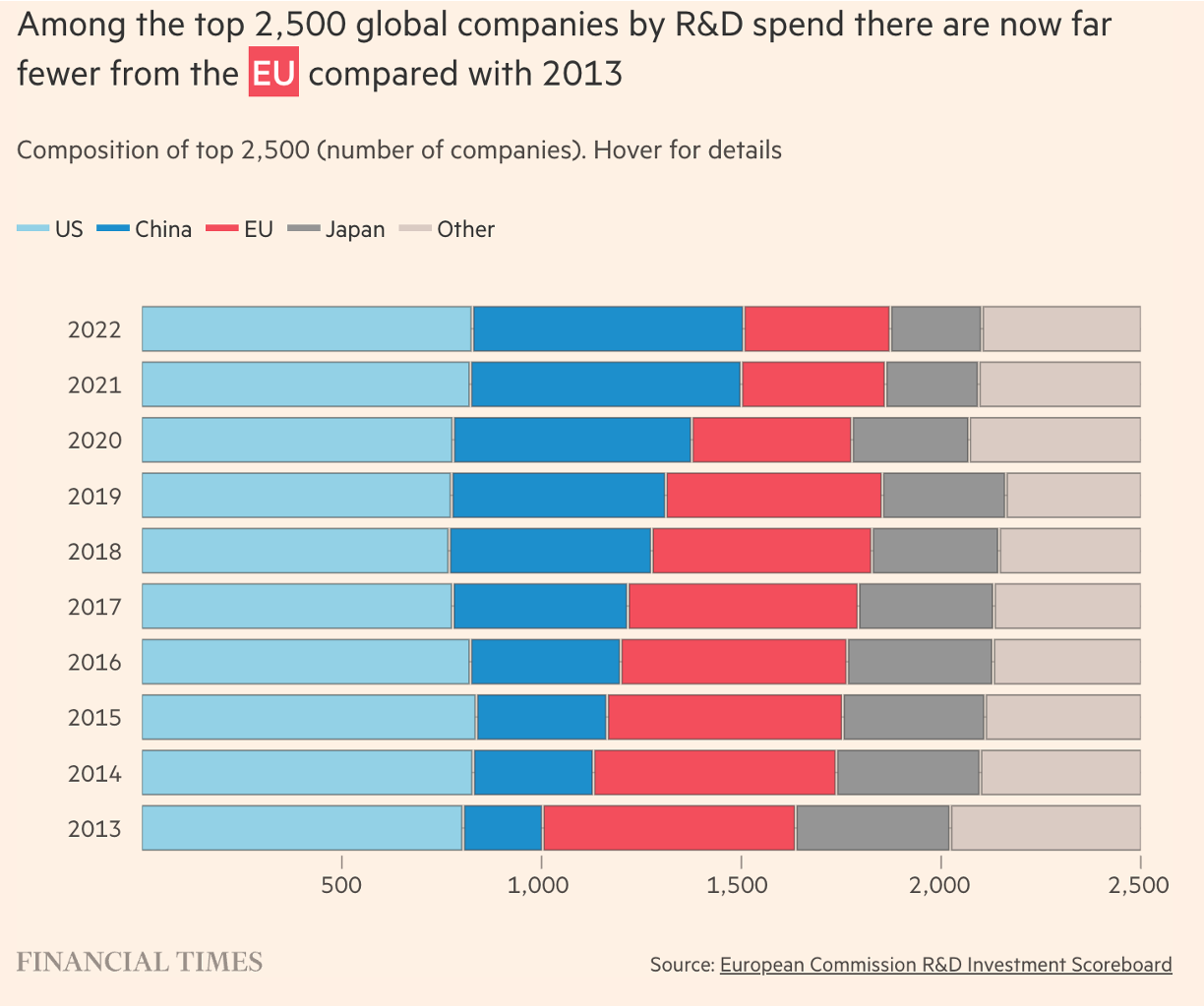

IMF forecasts crystallise the growing economic divide: 2.8% growth for the US versus 0% for Germany, 1.1% for France, and 1.1% for the UK. This divergence stems from structural differences in R&D investment ($700 billion in the US vs. €352 billion in the EU) and R&D intensity (3.5% vs. 2.22%). The concentration of R&D in high-growth tech sectors amplifies this divide, with European representation in the top 2,500 global R&D spenders declining over the past decade.

6. Political-Economic Realignment

Trump’s electoral victory in the US brought a number of key shifts with global impact:

- Bitcoin more than doubled to $100,000 on anticipated regulatory changes.

- There is an expectation that a business-friendly administration will lead to continued growth in the US, and combined with the US’s AI leadership, this makes the country an attractive investment destination. This was highlighted by SoftBank’s $100 billion US investment commitment.

- There is also expectation that M&A dealmaking will improve in the US, which is getting both Wall Street and the Private Equity & Venture Capital investment communities excited for the additional liquidity ahead.

- Global trade patterns are expected to recalibrate in response to Trumps’ proposed tariffs and more mercantilistic trade policy.

7. TikTok’s Regulatory Crucible

The platform’s trajectory in 2024 illustrated the complex interplay between national security concerns, market dynamics, and political imperatives.

Having first been targeted by Trump’s first administration for divestiture or closure, the platform was then let off the hook during the early part of Biden’s term. But the Biden administration thought the better of it and came back with legislation to divest or close Tiktok earlier this year. At the same time, Trump went from an adversarial stance on Tiktok to one that was more supportive of the platform

The January 10th 2025 Supreme Court showdown represents the culmination of bipartisan pressure for restrictions, multiple divestiture attempts, and shifting administrative positions—a microcosm of broader US-China tech relations.

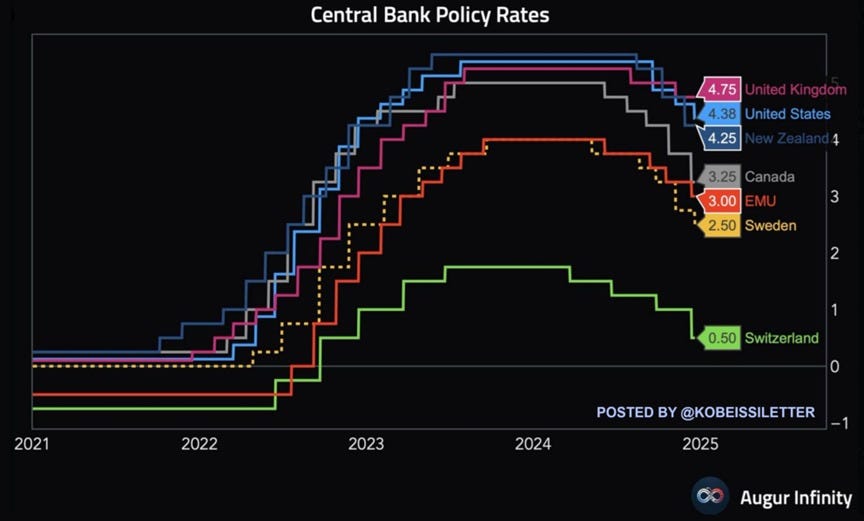

8. Inflation’s Divergent Impact

Persistent US inflation versus European disinflation is reshaping monetary policy trajectories. The Fed’s more conservative rate cut outlook, compared to the ECB’s aggressive stance, reflects these divergent paths. This monetary policy divergence is accelerating AI adoption as companies seek automation-driven cost efficiencies in a higher-rate environment.

9. Middle East’s Innovation Catalyst

2024 marked a watershed moment in Middle Eastern geopolitics with the systematic collapse of Iran’s primary regional proxies—Hamas, Hezbollah, and Syria’s Assad regime. This trifecta of strategic shifts has created the most significant opening for regional realignment in decades. The dissolution of these power structures, which have historically constrained regional integration, opens unprecedented pathways for economic and technological collaboration.

The potential Saudi-Israeli détente, likely to accelerate under a renewed Trump administration, could catalyze a fundamental rewiring of regional economic architectures. Israel’s potential integration into the Middle Eastern economic fabric would create powerful synergies: combining Israel’s technological innovation ecosystem—particularly in AI, cybersecurity, and water technology—with the Gulf states’ capital resources and market scale.

This realignment could unlock several strategic opportunities:

- Creation of integrated regional innovation corridors

- Cross-border venture capital flows linking Tel Aviv’s startup ecosystem with Gulf financial centers

- Joint development of critical infrastructure, from water security to digital transformation

- Shared platforms for technological advancement in energy transition and climate adaptation

The implications extend beyond immediate regional dynamics, potentially transforming global technology supply chains and creating new centers of innovation that bridge East and West. This shift would represent not just a peace dividend but a fundamental redrawing of the global innovation map.

10. The Reinvention of Europe

Europe has got great companies. Both startups and large corporates. On the startup side, Klarna made waves with a planned IPO at a $14-20 billion valuation, Revolut’s $45 billion secondary valuation, and Spotify reaching $100 billion market cap,

And on the corporate side, there are strong players including in the semiconductor space. ASML dominates semiconductor manufacturing equipment, Zeiss leads in precision optics (essential for semiconductors), and ARM’s chip designs power most mobile devices. But the region needs more than individual champions; it needs to build trillion-dollar technology companies that can compete at global scale.

To do that, the region needs to invest much more in R&D – especially in AI/Tech. The last decade has gone the wrong way, with Europe going from having roughly the same number of companies in the global top 2,500 for R&D as the US to having less than half. And the US spends more than the EU on R&D – ca. $700bn vs. €352bn. This is a combination of a bigger GDP and a higher R&D intensity (3.5% vs. 2.22%).

The flipside of this is a big opportunity to invest more in startups – both at the early stage and through the growth journey. European early stage startups still trades at a 50% discount to US peers. This provides investors with a great opportunity to invest early and reap the benefits as the next generation so startups become scaleups and global players.

Looking Forward

2024’s developments reveal how AI changes value creation across the global economy. The bifurcation between AI-capable and traditional enterprises and diverging regional growth trajectories suggest lots of upheaval ahead. The key question for 2025 is whether architectural innovation, as demonstrated by breakthroughs like DeepSeek’s, can democratise AI capabilities beyond the current concentration among capital-rich market leaders. And indeed, whether the US can hold on to its dominance.

2024 was an eventful year. Providing plenty to look forward to in 2025!