Public SaaS companies are still valued completely differently from other companies.

Or are they?

In yesterday’s post, I looked at how markets value public #SaaS companies as we enter 2023. The conclusion is that they are valued on (capital efficient) growth.

But how does this compare to how #markets value other businesses?

At face value, it looks like they are valued completely differently.

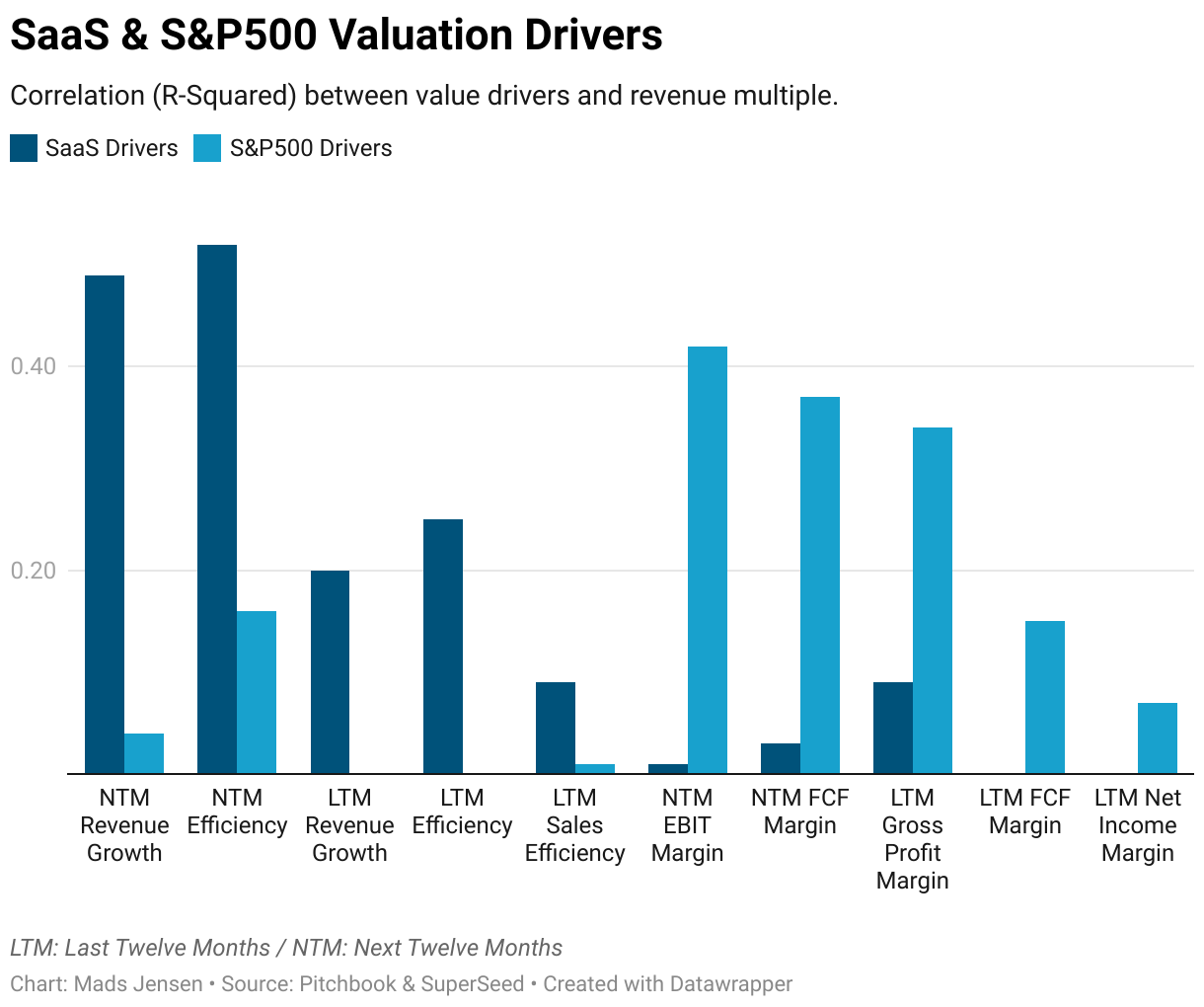

The valuation multiples of S&P500 companies mainly correlate to profit. The three best correlations are:

- EBIT Margin (0.42),

- Free Cash Flow Margin (0.37), and

- Gross Profit Margin (0.34).

On the other hand, the value of SaaS companies correlates to revenue growth (0.49).

The two approaches appear in stark contrast. But that is only until we take a step back and consider the overlaps. SaaS companies may not deliver profit today. But they are still expected to deliver plenty of Free Cash Flow in the future. And it's a combination of high growth and high gross margins that will get them there.

So when you think about it, the difference in valuation is mainly a timing thing. Jam today vs jam tomorrow (or five years from now).

And in an otherwise low-growth world, investors are still willing to pay well for the promise of future profits.