11 Predictions for the Year Ahead

This is not investment advice. Always consult qualified financial advisors before making investment decisions.

Welcome to our annual exercise in future-gazing. While I approach these forecasts with a healthy dose of humility and humour, I always find the exercise helpful. Consider this analysis part intellectual exploration, part strategic framework, and yes, perhaps a little part of fun too.

2025 promises to be a year of fascinating contradictions and transformative shifts. AI development evolves beyond internet-trained models to synthetic data generation, while China mounts a serious challenge to US AI supremacy. Markets face a correction even as M&A activity surges, echoing the dynamic interplay we saw in 2000-2001. Trump’s policy mix keeps inflation stubborn and rates high, yet Bitcoin could touch $150,000. Meanwhile, space exploration accelerates as humanity prepares for Artemis III’s return to the Moon.

These crosscurrents will reshape industries and markets in ways both subtle and profound. Let’s examine the key developments that could define 2025, understanding that while specific predictions may miss their mark, the underlying trends they represent warrant serious consideration.

AI and Technology

1. 2025 will continue to be driven by AI (probability: 100%)

Like 2023 and 2024, AI continues to remain the dominant global economic force and The key change in 2025 will be how AI models scale – shifting from internet data to synthetic data generation. We’re running out of quality internet text, but synthetic data offers nearly limitless potential.

Think of synthetic data like a massive simulation. Instead of learning from human-written content, AI systems create their own training examples, test them, and learn from the results. Imagine millions of virtual students working through math problems – they try different approaches, keep track of what works, and discard what doesn’t. Over time, they discover better and better ways to solve problems. This works well for domains with clear right and wrong answers like mathematics, coding, and physics, where success can be objectively measured. Less so for subjective areas like art or creative writing.

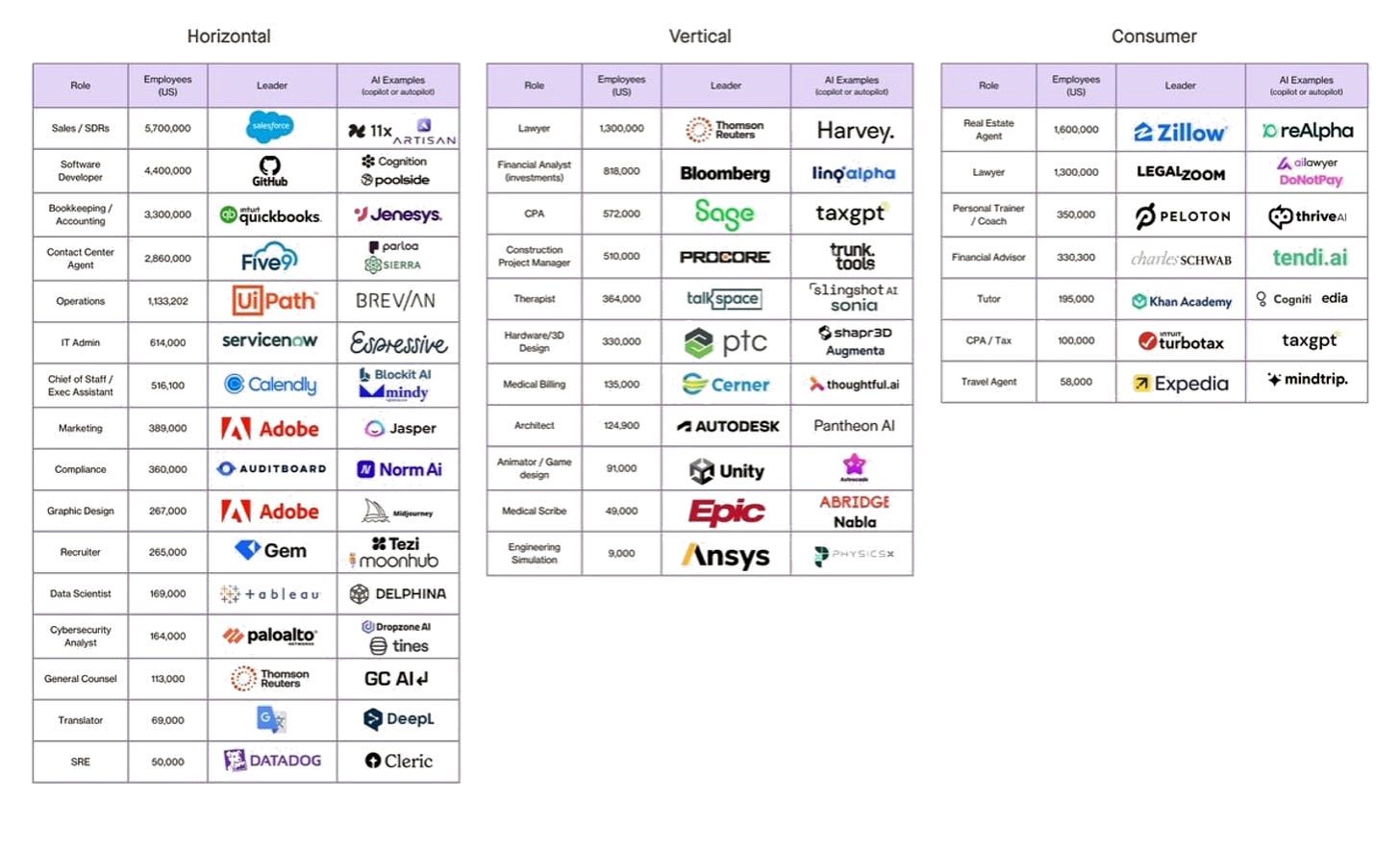

The second major shift is toward agentic AI – systems that don’t just respond to questions but actively perform tasks. Think of traditional AI as a smart assistant who answers questions. Agentic AI is more like an employee who takes initiative and gets things done. Salesforce is pioneering this transition, moving from charging per user to charging based on outcomes like “conversations handled” or “deals closed.” This fundamentally changes how we think about software – from tools we use to agents that work for us.

The robotics revolution is accelerating in parallel. Nvidia’s upcoming Jetson Thor platform, launching in early 2025, represents a step-change in humanoid robot capabilities. It combines unprecedented processing power with sophisticated AI to enable robots that can understand their environment and interact with it naturally. Toyota’s recent demonstrations show robots performing complex athletic movements that seemed impossible just months ago. The line between digital and physical AI is starting to blur.

2. AI Capex will continue to increase in 2025 (probability: 80%)

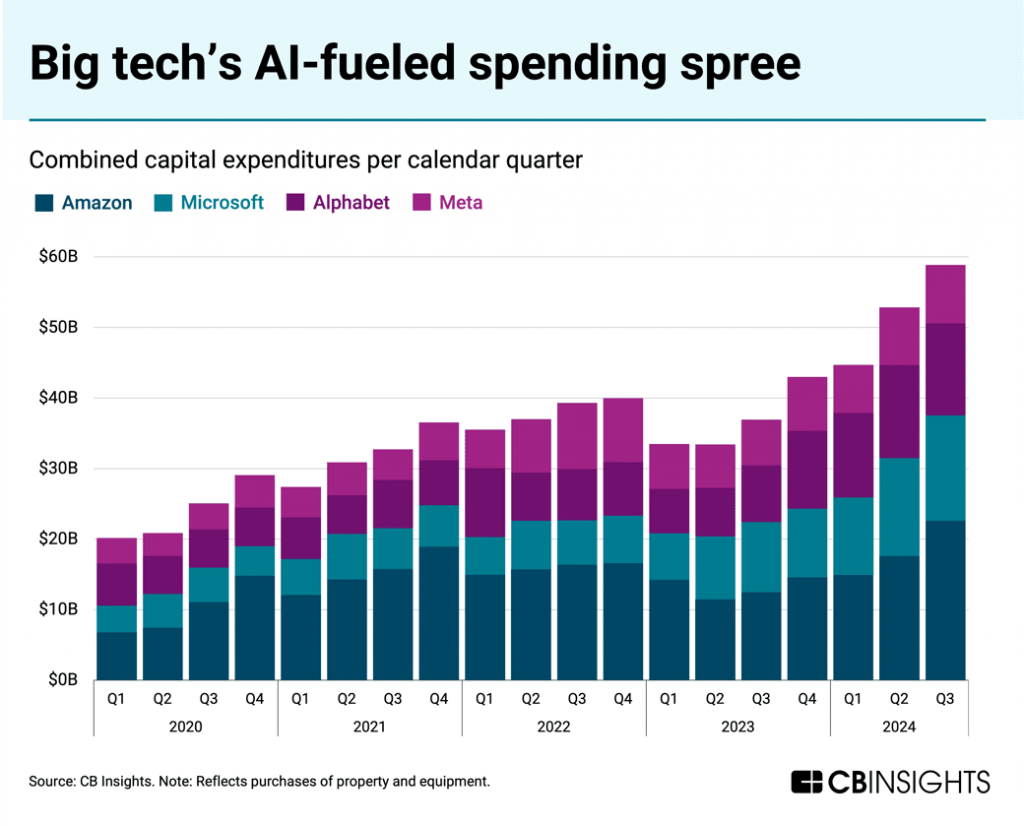

Major tech players view AI investment as a Pascal’s Wager – they can’t risk being left behind. Microsoft’s $30 billion Nvidia chip order demonstrates this mindset. While Google bought fewer Nvidia chips, they’re generating 70% of their compute from in-house TPUs (Google’ proprietary AI chips). This trend will accelerate as synthetic data training demands even more computing power.

3. OpenAI’s dominance will be severely challenged (probability: 85%)

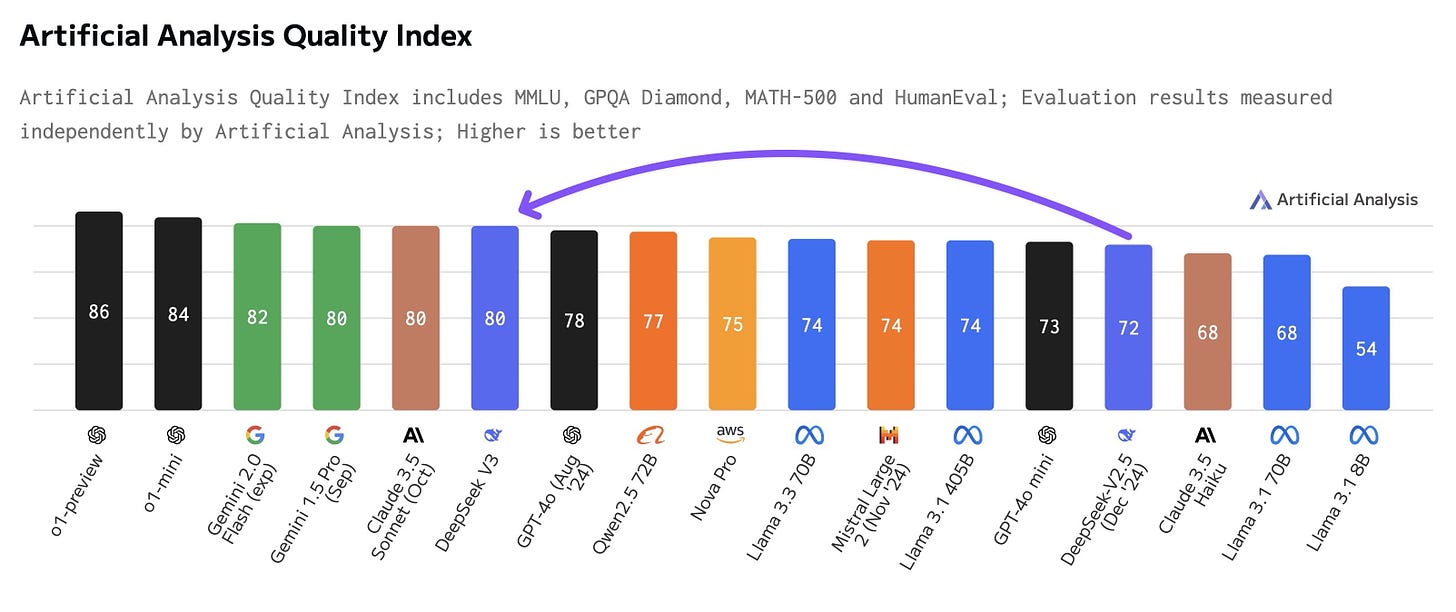

While OpenAI may maintain its user interface edge, expect Google, xAI and Anthropic to take the lead in raw model performance. The differences are already emerging: While OpenAI’s ChatGPT leads in speed, xAI’s Grok excels at integrations, Claude demonstrates superior reasoning and Gemini handles the largest files. OpenRouter data shows Anthropic already leading in embedded usage for next-gen applications, followed by Meta/Llama, Deepseek and Google/Gemini.

Geopolitics

4. US AI dominance eroded by China (probability: 95%)

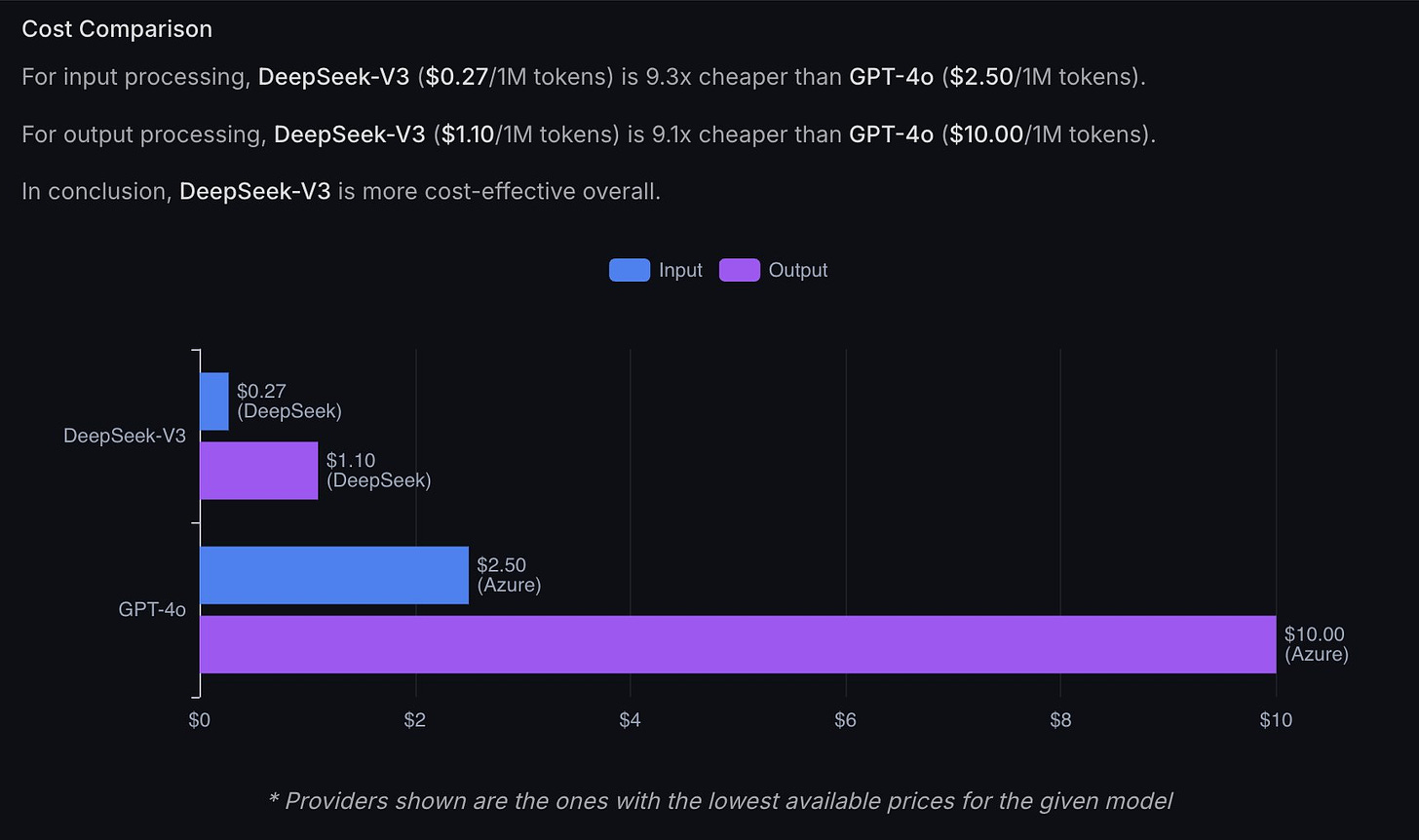

The assumed inevitability of US dominance in advanced AI systems faces unprecedented challenges in 2025. Chinese companies have cracked the code on efficient model development, fundamentally challenging the prevailing wisdom that competitive AI requires massive capital deployment. DeepSeek’s emergence offers a compelling case study: their models achieve performance metrics comparable to leading US systems while requiring substantially less computational infrastructure and training resources.

China’s coordinated approach to AI development demonstrates the power of strategic alignment between state directives and commercial execution. Their 2023 mandate for humanoid robotics advancement set aggressive milestones – major breakthroughs by 2025, economic driver status by 2027 – with early results suggesting these targets may have been conservative. The recent procurement of one million autonomous drones showcases both China’s manufacturing sophistication and its ability to rapidly operationalize AI advances into tangible capabilities.

This evolution threatens to reshape the global AI landscape. While US companies maintain advantages in fundamental research and specialized applications, China’s emerging model of efficient development and scaled deployment presents a formidable alternative path to AI leadership.

5. TikTok banned in the US (probability: 95%)

The TikTok ban trajectory exemplifies how technology platforms have become geopolitical chess pieces. Despite overwhelming bipartisan congressional support for the ban, Trump’s recent pivot to opposing TikTok restrictions introduces a crucial element of uncertainty. His current stance – arguing that a ban would strengthen Meta’s market position – marks a stark reversal from his earlier attempts to force TikTok’s sale during his first term.

Three structural factors still point toward an eventual ban. First, there’s the reciprocity dynamic: China’s systematic exclusion of Western social media platforms has eliminated any diplomatic cost to U.S. action. Second, evidence continues mounting about CCP influence operations through TikTok’s algorithm, which appears to amplify divisive content while suppressing topics sensitive to Beijing. Third, sophisticated technical analysis raises alarming questions about TikTok’s data collection practices, suggesting capabilities far beyond typical social media telemetry.

With the Supreme Court hearing scheduled for January 10th, the probability approaches but doesn’t quite reach certainty. That 5% doubt stems primarily from Trump’s opposition potentially complicating the political calculus. The ban’s implementation pathway exists, but its timing and exact form may prove more complex than current congressional momentum suggests.

Economics

6. US Inflation remains stubborn (probability: 80%)

The defining economic story of 2025 looks to be inflation’s persistence. Trump’s policy trifecta – tariffs, immigration restrictions, and continued fiscal deficits – all point toward sustained inflationary pressure.

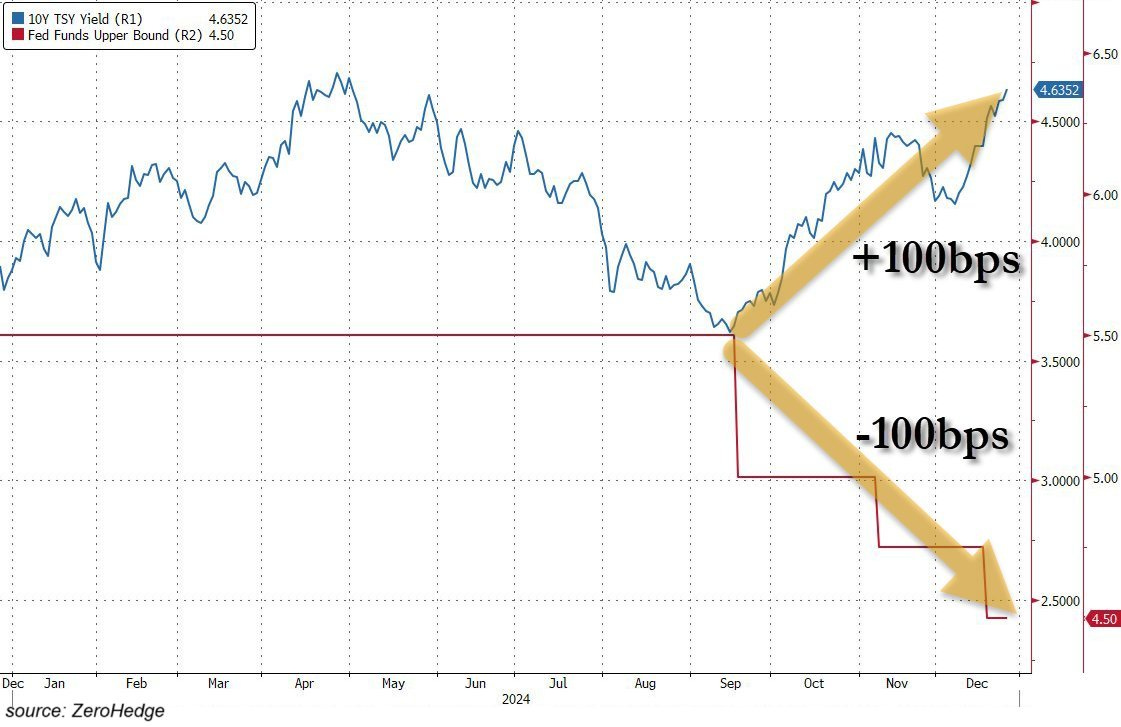

Markets are already pricing in this reality. Bond yields have risen nearly 100 basis points since the Fed began its rate-cutting cycle, suggesting rates will stay higher than previously expected. This “higher for longer” scenario sets the stage for significant market repricing and shapes both investment and M&A strategies through 2025.

7. US recession finally arrives (probability: 70%)

The warning signs are mounting for a recession, though likely milder than historical downturns. After dodging recession in 2024 and achieving nearly 3% GDP growth, the cracks are starting to show.

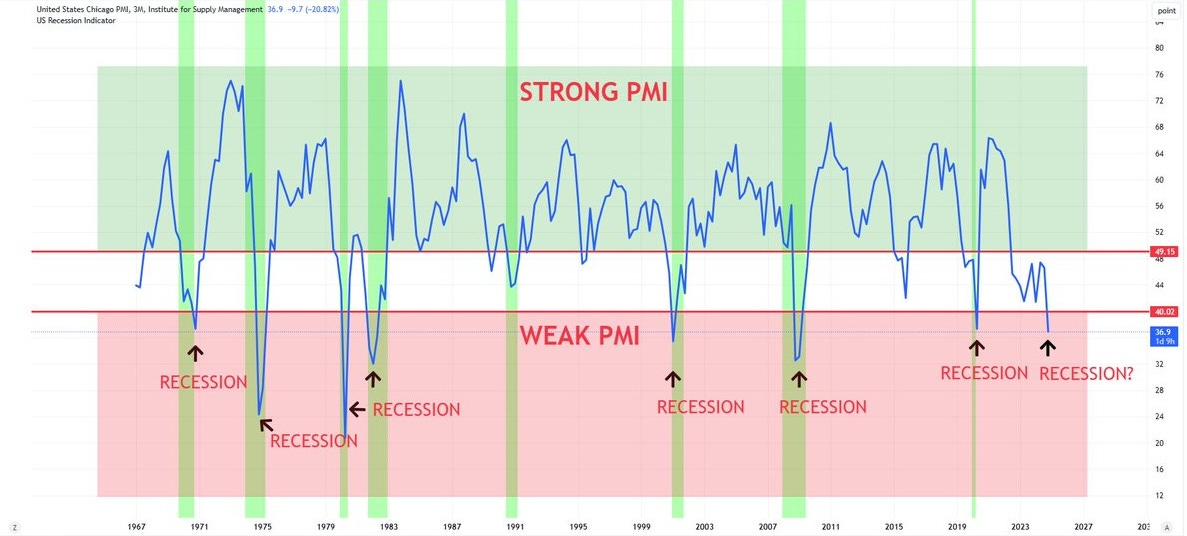

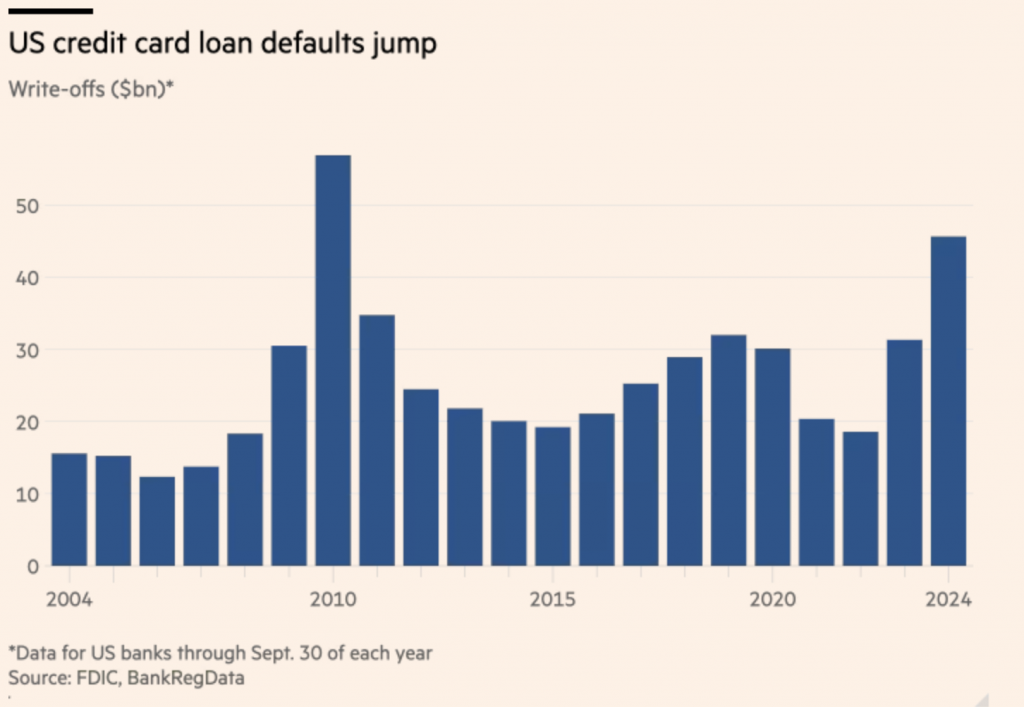

The Chicago PMI sits at a concerning 36.9, full-time private sector employment has contracted by 1.8 million year-over-year, and industrial capacity utilization has dropped to 76.8%. Most concerning is the surge in credit card defaults to 2010 levels, suggesting consumer resilience is finally wavering.

Yet several factors suggest this won’t be a severe downturn. Corporate balance sheets remain strong, especially in tech, where AI investment continues unabated. Government spending shows no signs of contraction. The likely scenario? A mild recession as the economy digests higher rates and the market correction, cushioned by ongoing technological transformation and fiscal stimulus.

Finance

8. The S&P 500 will undergo a major correction (probability: 90%)

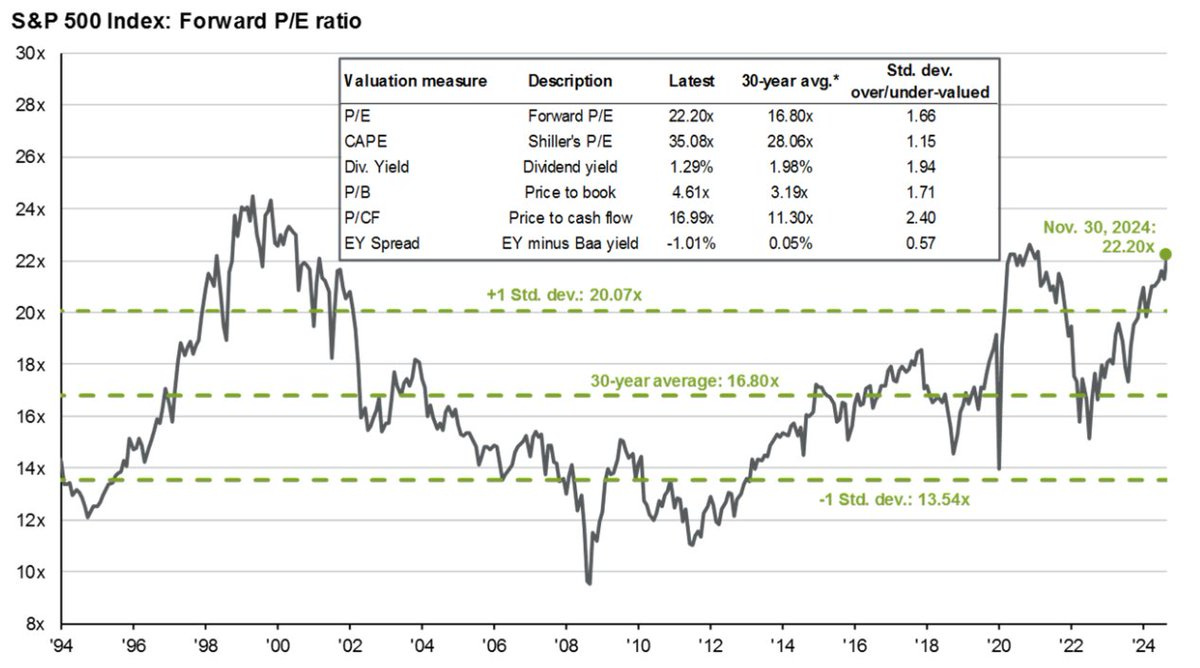

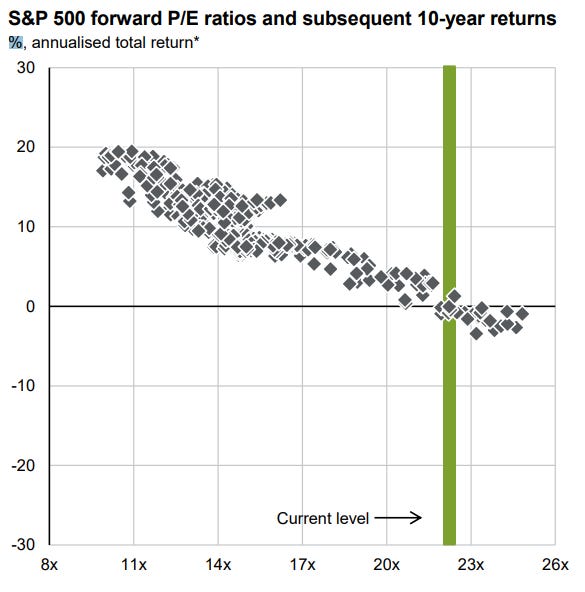

With inflation proving sticky and rates staying higher than expected, a significant market correction looks increasingly likely in 2025. This won’t be a crash, but rather a necessary repricing as markets adjust to the new reality. Markets have stretched to precarious levels, with half of S&P 500 companies trading above 20x forward Price/Earnings – levels only seen during the dotcom bubble and zero-rate/Covid era.

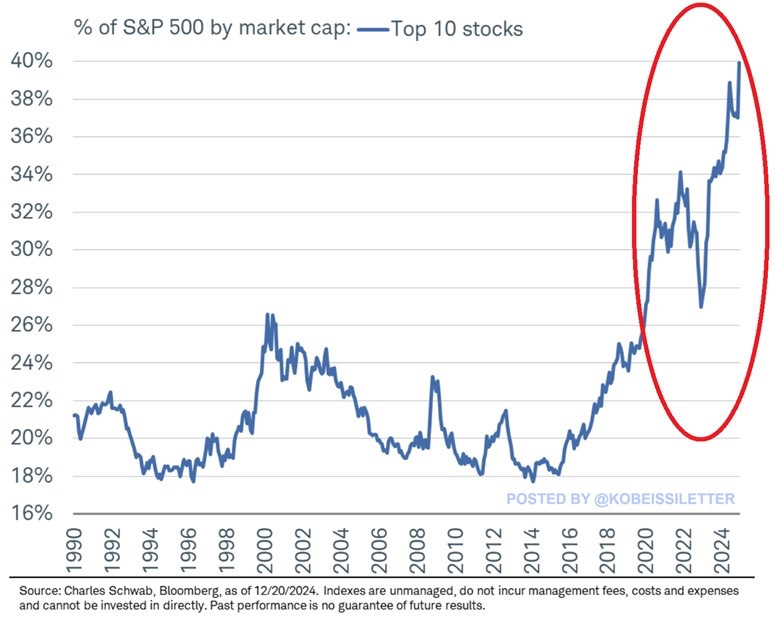

Market concentration has reached extreme levels – the top 10 US stocks now represent 40% of S&P 500 market cap ($20.9 trillion), exceeding the entire European market by $4.9 trillion.

At the same time, corporate insider selling has hit its highest level since 2004. Not surprising given the historical relationship bewteeen forward P/E ratios and actual 10-year returns.

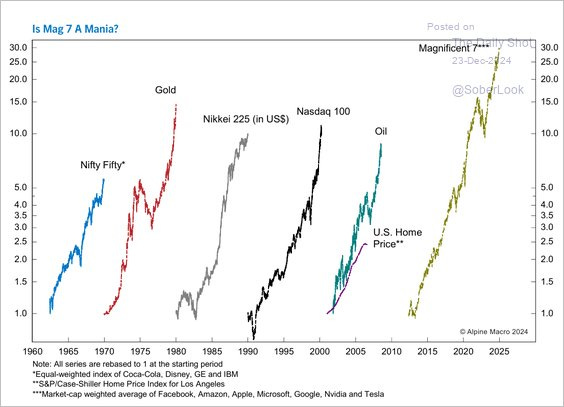

So we have near record valuation levels driven by a very small number of stocks. For fun, here is a comparison between Mag 7 and previous bubbles (Nasdaq100 is the dotcom bubble).

The tech sector, with its elevated multiples, looks particularly vulnerable. Expect a 15-25% correction over several months as the market adjusts to the higher rate environment.

9. M&A activity will increase (probability: 90%)

Counter-intuitively, this market correction could catalyze a surge in M&A activity. We’re seeing echoes of 2000-2001, when stronger companies used market weakness to acquire strategic assets at better valuations. Several factors align to make this scenario likely:

First, there’s massive pent-up demand – deals that have been in preparation for years but held back by regulatory uncertainty and market conditions. The appointment of Andrew Ferguson to replace Lina Khan marks a sea change in antitrust enforcement. Khan’s aggressive stance against big tech acquisitions and vertical integration created a chilling effect on deals. Ferguson’s more traditional approach to antitrust should unlock many transactions that were previously considered too risky.

The return of Trump to the White House adds fuel to this fire. His administration’s business-friendly approach creates perfect conditions for deal-making. There’s also a psychological element – as some long-delayed deals finally close, others will rush to act before their strategic options disappear. Nobody wants to be left without a chair when the music stops.

The nature of deals will likely shift too. While previous years saw mainly tactical acquisitions for specific technologies or talent, expect more transformative mergers in 2025. Cash-rich companies that weathered the correction will look to reshape their industries. Tech giants, temporarily constrained under Khan’s FTC, will resume their acquisition sprees. The only major headwind? Despite Fed rate cuts, stubbornly high bond yields make debt financing more expensive than ideal. But with so many potential buyers sitting on large cash reserves, even this may not significantly dampen activity.

Cryptocurrency

10. Bitcoin will reach $150,000 (probability: 75%)

Bitcoin’s prospects have transformed since the Biden era. Trump’s policy shift has mainstreamed the cryptocurrency, with BlackRock’s Larry Fink ($11.5 trillion AUM) turning bullish. There’s growing momentum for the US to swap some gold reserves for Bitcoin, and even Germany’s former Finance Minister advocates for Bitcoin in central bank reserves. While volatility will persist, the secular trend points upward.

Space Technology

11. The space race will accelerate with several important missions taking place before Artemis III in 2026 (probability: 85%)

2025 marks the crucial setup year for humanity’s return to the Moon with Artemis III in 2026. It’s a year packed with missions that will prove critical technologies: NASA’s Commercial Lunar Payload Services will test precision landing systems, while Japan’s M2/Resilience mission aims to crack the vital challenge of extracting water from lunar soil. China joins the race with Tianwen-2, pushing boundaries by attempting both asteroid sample collection and comet exploration in a single mission. Meanwhile, NASA’s SPHEREx will map the chemical evolution of our universe across 450 million galaxies, and ESA’s reusable Space Rider will revolutionize our access to microgravity research. Each mission in 2025 is a building block toward permanent human presence beyond Earth – testing the technologies we’ll need for Artemis III and beyond.

Looking Ahead: Key Themes for 2025

As we look to 2025, several major themes emerge. AI continues as the dominant force, but with concerning developments in military applications – China’s million-drone order signals a fundamental shift in warfare that demands new defence strategies.

Europe faces critical challenges, particularly in manufacturing competitiveness. The collapse of its automotive sector against Chinese competition in 2024 demands urgent action. More German entrepreneurs are building unicorns in the US than in Germany, while America’s poorest states now outperform major European economies on GDP. European innovation needs a renaissance in 2025.

Yet there’s room for optimism. The Middle East could see its first comprehensive realignment in decades, with Iran’s influence waning and potential for new Saudi-Israeli cooperation. Healthcare advances are accelerating – from the UK’s groundbreaking ovarian cancer vaccine trials to AI-powered laser surgery restoring better-than-normal vision to a legally blind patient. 2025 might even mark the year we reach “escape velocity” in life expectancy, adding more than one year for each calendar year.

The key themes to watch:

- AI development and deployment

- Energy infrastructure for AI computing

- Manufacturing competitiveness

- Cybersecurity imperatives

- AI-enabled healthcare breakthroughs

In an uncertain world, one thing remains clear: 2025 will demand adaptability, strategic thinking, and careful navigation of risks and opportunities. While we can’t predict the future with certainty, it sure is fun to try.

Remember: These predictions represent informed speculation based on current trends. The future often surprises us. Always do your own research and consult your IFA before making investment decisions.